🎯 Role & Responsibilities

🏦 EMPIRE STOCK TRANSFER & CUSTODY FAQ

Regulated Custody for SEC Category 1 Tokenized Securities

✅ SEC CATEGORY 1 COMPLIANT | Issuer-Sponsored Tokenized Securities pursuant to SEC Division of Corporation Finance, Division of Investment Management, and Division of Trading and Markets Joint Statement dated January 28, 2026

🏦 EMPIRE STOCK TRANSFER ROLE

Q: What is Empire Stock Transfer's role in the OTCOTCM MemeProtocol ecosystem?

✅ SEC CATEGORY 1 COMPLIANT | Issuer-Sponsored Tokenized Securities pursuant to SEC Division of Corporation Finance, Division of Investment Management, and Division of Trading and Markets Joint Statement dated January 28, 2026

A: Empire Stock Transfer serves as the SEC-registered transfer agent and qualified custodian for all Series "M" shares:Preferred Shares backing ST22 Tokenized Securities. This role is essential for SEC Category 1 compliance.

🛡️

OurCustody Responsibilities:

// Custody account specifications

interface CustodyAccount {

// Account namingStructure 📛

naming: "OTCOTCM MemeProtocol - [SYMBOL] Series 'M' Reserve";

type: "Segregated Custody Account";

status: "Permanently Restricted";

// Category 1 Compliance 🏛️

category1: {

regulatedCustody: true, // SEC-registered custodian

trueEquityBacking: true, // Real shares, not derivatives

clearOwnershipChain: true, // CUSIP + Golden Medallion

investorProtection: true // Oracle verification

};

// Security featuresFeatures 🛡️

security: {

segregation: "Completely separate from companyissuer accounts",

restrictions: "No tradingtrading, allowed"transfer, or withdrawal permitted",

permanentLock: "ExceptIrrevocable custody deposit",

legends: "Restrictive legends on share certificates",

goldenMedallion: "Golden Medallion Guarantee required for tokenany holder redemptions",

additionalLegends: "Extra restrictive markings"movement"

};

// Access controlsControls 🚫

access: {

companyAccess:issuerAccess: false, // Issuer CANNOT access

otcmProtocolAccess: false, // OTCM Protocol CANNOT access

tradingEnabled: false, // No trading permitted

withdrawalRights: "TokenProtective holdersconversion only",

modification: "Permanently prohibited"

};

// Verification 🔐

verification: {

oracleIntegration: true, // Real-time verification

frequency: "Every ~400ms", // Continuous monitoring

cryptographicProof: true, // Cryptographic attestation

auditTrail: "Complete and immutable"

};

}

| Holding Type | Status | Security |

|---|---|---|

| 📜 Physical Certificates | Held in secure vault | Restrictive legends applied |

| 💻 Book-Entry | Electronic records | System-enforced restrictions |

| 🔐 Both | Equivalent protection | Same custody rules apply |

Q: Can companies ever access their deposited shares?

A: Absolutely not. Empire Stock Transfer will automatically reject any companyissuer attempts to:

┌─────────────────────────────────────────────────────────────┐

│ CUSTODY PROTECTION LAYERS │

├─────────────────────────────────────────────────────────────┤

│ │

│ Layer 1: LEGAL AGREEMENTS │

│ ├── Tripartite Agreement prohibits access │

│ ├── Severe penalty clauses │

│ └── Fiduciary duty to token holders │

│ │

│ Layer 2: EMPIRE STOCK TRANSFER SYSTEMS │

│ ├── Account flagged as "PERMANENT CUSTODY" │

│ ├── No issuer access credentials exist │

│ ├── Golden Medallion required (issuer cannot obtain) │

│ └── Staff trained to reject all issuer requests │

│ │

│ Layer 3: SMART CONTRACT ENFORCEMENT │

│ ├── Issuer wallets blacklisted for redemption │

│ ├── Transfer Hooks verify custody on every transaction │

│ └── Cannot mint tokens without verified custody │

│ │

│ Layer 4: REGULATORY OVERSIGHT │

│ ├── SEC supervision of transfer agent │

│ ├── Category 1 compliance requirements │

│ └── Audit trail for regulatory examination │

│ │

└─────────────────────────────────────────────────────────────┘

Q: What happens to the shares in different scenarios?

| Scenario | What Happens to Shares |

|---|---|

| 🏢 Normal Operations | Remain in custody indefinitely |

| 📈 Token Price Increases | Remain in custody (no change) |

| 📉 Token Price Decreases | Remain in custody (no change) |

| 💰 Issuer Wants Shares Back | Rejected — shares remain in custody |

| 🔄 Issuer Merger/Acquisition | Protective conversion may trigger |

| 💸 Issuer Bankruptcy | Protective conversion triggers → common stock |

| 🏛️ SEC Enforcement | Protective conversion triggers → common stock |

| ⚖️ Criminal Indictment | Protective conversion triggers → common stock |

| 🚫 OTCM Protocol Failure | Shares remain safe; conversion rights preserved |

Q: What is the Golden Medallion Signature Guarantee?

A: The Golden Medallion Guarantee is a critical security feature for Category 1 compliance:

What It Is

| Aspect | Description |

|---|---|

| 🎖️ Definition | Signature guarantee from authorized financial institution |

| 📜 Programs | STAMP, SEMP, or MSP medallion programs |

| 🏦 Issuers | Banks, broker-dealers, credit unions |

| 🔐 Purpose | Authenticates share transfers and prevents fraud |

Role in Category 1 Compliance

| Function | How It Supports Category 1 |

|---|---|

| 🔗 Clear Ownership Chain | Authenticates every transfer in custody chain |

| 🛡️ Investor Protection | Prevents unauthorized transfers |

| 📋 Audit Trail | Creates verifiable record of share movements |

| 🏦 Institutional Standard | Required by SEC-registered transfer agents |

Why Issuers Cannot Circumvent Custody

| Protection | Explanation |

|---|---|

| 🚫 Cannot Obtain Medallion | Issuers cannot get Medallion for their own custodied shares |

| 🏦 Bank Verification | Medallion issuers verify identity and authority |

| 📋 Liability | Medallion issuer liable for unauthorized transfers |

| 🔒 System Design | Designed specifically to prevent unauthorized access |

🔍 VerificationVERIFICATION & OracleORACLE SystemSYSTEM

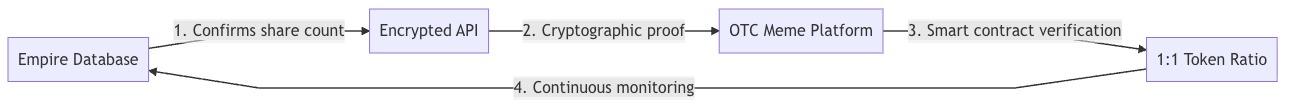

Q: How does the verification system work?

A: OurEmpire Stock Transfer operates a Reserve Oracle systemSystem that provides real-time verification:cryptographic verification to OTCM Protocol's Transfer Hooks:

Oracle

Architecture🔄┌─────────────────────────────────────────────────────────────┐

Process:

- CUSTODY

💾ORACLEDatabaseSYSTEM │ ├─────────────────────────────────────────────────────────────┤ │ │ │ ┌─────────────────┐ │ │ │ EMPIRE STOCK │ │ │ │ TRANSFER │ │ │ │ ─────────────── │ │ │ │ • Share Count │ │ │ │ • Custody Status│ │ │ │ • CUSIP Verify │ │ │ │ • Trigger Watch │ │ │ └────────┬────────┘ │ │ │ │ │ │ Cryptographic Attestation │ │ │ (Every ~400ms) │ │ ▼ │ │ ┌─────────────────┐ │ │ │ ORACLE BRIDGE │ │ │ │ ─────────────── │ │ │ │ • Encrypt Data │ │ │ │ • Sign Message │ │ │ │ • Timestamp │ │ │ │ • Transmit │ │ │ └────────┬────────┘ │ │ │ │ │ │ Signed Verification │ │ ▼ │ │ ┌─────────────────┐ │ │ │ TRANSFER HOOK │ │ │ │ ─────────────── │ │ │ │ • Verify Sig │ │ │ │ • Check 1:1 │ │ │ │ • Block if Fail │ │ │ │ • Allow if Pass │ │ │ └─────────────────┘ │ │ │ └─────────────────────────────────────────────────────────────┘Verification Process

Step Action Frequency 1️⃣ Empire database confirms exact share count (1,000,000,000) 🔐Continuous EncryptedAPIsends2️⃣ Oracle bridge creates cryptographic proofattestation🤖Every Smart~400mscontractsverify3️⃣ Signed message transmitted to Solana network Real-time 4️⃣ Transfer Hook verifies signature and data Per transaction 5️⃣ Transaction approved ONLY if 1:1 ratio 👁confirmedPer transaction What Gets Verified

Verification Description Failure Action 📊 Share Count Exactly 1,000,000,000 shares in custody Block all transactions 🔐 Custody Status Account in "PERMANENT CUSTODY" status Block all transactions 📋 CUSIP Match CUSIP matches registered Series M Block all transactions ⚠️ ContinuousTriggermonitoringEventsensuresNo complianceprotective conversiontriggers active

Initiate conversion 🏦 Empire Status Empire Stock Transfer operational Block all transactions

Q: What information does Empire share with the platform?

A: Empire Stock Transfer shares

Onlyonly essential verificationdata:data required for Category 1 compliance:✅ Data Shared with OTCM Protocol

Data Type Purpose Sensitivity ✅ Shared:✅Confirmation ofshareSharedepositDeposit

Verify custody established Low 📊 Current Share Count Verify 1:1 backing ratio Low 🔍 Series Type Verification Confirm Series M designation Low 📋 CUSIP Verification Clear ownership chain Low 🔄 Conversion Ratio Status Track any conversions Low ⚠️ Trigger Event Monitoring Protective conversion alerts Medium 🏦 Custody Account Status Operational verification Low 🚫 Data NEVER Shared

Data Type Reason Protection 🔒 Confidential Company Information Privacy laws Encrypted at rest 💰 Issuer Financial Details Business confidentiality Not collected 👥 Shareholder Personal Information Privacy regulations Segregated systems 📋 Private Corporate Records Attorney-client privilege Not retained 🏦 Other Client Information Fiduciary duty Complete segregation Data Security Standards

Standard Implementation 🔐 Encryption AES-256 encryption in transit and at rest 🛡️ Access Control Role-based access, multi-factor authentication 📋 Audit Logging Complete audit trail of all data access 🏛️ Compliance SOC 2 Type II certified 🔍 Monitoring 24/7 security monitoring

Q: What happens if the oracle system fails?

A: Multiple safeguards protect against oracle failure:

Failsafe Mechanisms

Mechanism Action 🔴 Circuit Breaker Trading automatically halts if oracle offline ⏰ Stale Data Detection Transactions blocked if verification >5 minutes old 🔄 Redundant Oracles Multiple oracle nodes for failover 📋 Manual Verification Human verification available for critical operations 🛡️ Conservative Default System defaults to BLOCK if any uncertainty Oracle Failure Scenarios

Scenario System Response 📡 Network Outage Trading halted until connection restored 💻 Oracle Node Failure Failover to backup nodes 🔐 Signature Invalid Transaction blocked, security alert ⏰ Stale Data Trading halted, fresh verification required 🏦 Empire System Down Trading halted until Empire operational 🛡️ Key Principle: The system is designed to fail safe—any uncertainty results in blocked transactions, never false approvals.

🔄 PROTECTIVE CONVERSION

Q: What is protective conversion and how does Empire Stock Transfer handle it?

A: Protective conversion automatically converts Series "M" Preferred Shares to common stock when adverse events occur:

Trigger Events

Trigger Detection Action 💸 Bankruptcy Filing Court filing monitoring Conversion initiated 🏛️ SEC Enforcement Public enforcement action Conversion initiated ⚖️ Criminal Indictment Public records monitoring Conversion initiated 🔄 Adverse Merger Corporate action notification Conversion initiated 🏢 Dissolution State filing monitoring Conversion initiated 🚨 Material Adverse Event Per Certificate of Designation Conversion initiated Conversion Process

┌─────────────────────────────────────────────────────────────┐ │ PROTECTIVE CONVERSION PROCESS │ ├─────────────────────────────────────────────────────────────┤ │ │ │ Step 1: TRIGGER DETECTION │ │ ├── Oracle monitors for trigger events │ │ ├── Event detected and verified │ │ └── Alert sent to Empire Stock Transfer │ │ │ │ Step 2: VERIFICATION │ │ ├── Empire confirms trigger event validity │ │ ├── Legal review if required │ │ └── Conversion authorized │ │ │ │ Step 3: SHARE CONVERSION │ │ ├── Series M shares converted to common stock │ │ ├── Per conversion ratio in Certificate of Designation │ │ └── New common shares recorded │ │ │ │ Step 4: TOKEN HOLDER NOTIFICATION │ │ ├── On-chain event emitted │ │ ├── Token holders notified of conversion │ │ └── Claim process initiated │ │ │ │ Step 5: CLAIM PROCESSING │ │ ├── Token holders submit conversion claims │ │ ├── Empire verifies token ownership │ │ └── Common shares issued to verified holders │ │ │ └─────────────────────────────────────────────────────────────┘What Token Holders Receive

Before Conversion After Conversion ST22 tokens representing Series M Common stock in issuer company Trade on CEDEX Trade per applicable securities laws Rights per Certificate of Designation Standard common shareholder rights Empire custody (indirect) Direct registration or broker custody ⚠️ Important: Conversion to common stock does NOT guarantee value. In bankruptcy, common stock may have zero value. Protective conversion ensures token holders have the same rights as other shareholders.

📋 COMPLIANCE & AUDIT

Q: How does Empire Stock Transfer maintain compliance?

A: Empire Stock Transfer maintains comprehensive compliance for Category 1 requirements:

Regulatory Compliance

Requirement Implementation 📜 SEC Registration Current SEC transfer agent registration 🏦 Examination Subject to SEC examination 📋 Record Keeping Maintain records per SEC Rule 17Ad 🔐 Cybersecurity SOC 2 Type II compliance 📊 Reporting Annual compliance reporting OTCM Protocol-Specific Compliance

Requirement Implementation 🏦 Regulated Custody Category 1 qualified custody 💎 1:1 Backing Continuous verification 🔗 Ownership Chain CUSIP + Golden Medallion 🛡️ Investor Protection Oracle integration 📋 Audit Trail Complete transaction history Audit Capabilities

Audit Type Frequency Scope 🔍 Internal Audit Quarterly Operational compliance 📊 External Audit Annual SOC 2 Type II 🏛️ Regulatory Exam As scheduled SEC examination 💻 System Audit Continuous Oracle and security

Q: What records does Empire Stock Transfer maintain?

A: Comprehensive records for regulatory compliance and audit:

Record Type Retention Purpose 📜 Custody Agreements Permanent Legal documentation 📊 Share Balances Permanent 1:1 verification 🔄 Transaction History 7 years minimum Audit trail 🔐 Oracle Logs 7 years Verification records 📋 Correspondence 5 years Communication records ⚠️ Trigger Events Permanent Conversion documentation 🎖️ Medallion Records Permanent Transfer authentication

❓ ADDITIONAL QUESTIONS

Q: What if Empire Stock Transfer goes out of business?

A: Multiple protections ensure continuity:

Protection Description 📜 SEC Oversight SEC supervises transfer agent transitions 🔄 Successor Custodian Tripartite Agreement specifies successor process 📋 Record Transfer All records transferred to successor 🛡️ Share Protection Shares cannot be lost—must transfer to qualified successor ⚖️ Legal Framework Transfer agent regulations ensure continuity

Q: Can token holders contact Empire Stock Transfer directly?

A: For most inquiries, token holders should contact OTCM Protocol. However:

Inquiry Type Contact 🔄 Protective Conversion Claims Empire Stock Transfer directly 📋 Shareholder Registration After conversion, Empire directly 🏦 Custody Verification Via OTCM Protocol (oracle system) ❓ General Questions OTCM Protocol support Contact Information

Contact Purpose 📧 custody@empirestocktransfer.com Custody inquiries 📞 [Phone Number] Conversion claims 🌐 www.empirestocktransfer.com General information

Q: How does Empire Stock Transfer coordinate with OTCM Protocol for new tokenizations?

A: Structured onboarding process:

Step Empire Role OTCM Protocol Role 1️⃣ Open custody account Complete issuer KYB 2️⃣ Verify share countcertificates🔍Draft SeriesCertificatetypeof Designation3️⃣ Apply restrictive legends State filing coordination 4️⃣ Confirm deposit Mint ST22 tokens 5️⃣ Activate oracle feed Enable Transfer Hooks 6️⃣ Ongoing verification 🔄Ongoing Conversioncomplianceratiostatus

📋 Document Information

Field Value 📄 Document Version 3.0 📅 Last Updated January 2026 📍 Jurisdiction United States 🏛️ Regulatory Framework SEC Category 1 (Issuer-Sponsored Tokenized Securities) 🏦 Custodian Empire Stock Transfer Inc. (SEC-registered transfer agent)

⚠️

TriggerDisclaimer:eventThismonitoringFAQ provides general information about custody arrangements for OTCM Protocol's Category 1 tokenized securities. It does not constitute legal or investment advice. Consult qualified professionals for specific guidance.

🔒StockConfidentialTransfercompanyInc.informationis 💰anFinancialindependent,detailsSEC-registered 👥transferShareholderagentlistsproviding 📋qualifiedPrivatecustodycorporateservicesrecordsfor

🚫© Never2026 Shared:OTCM Protocol, Inc. | All Rights Reserved

Empire

Tokenized Securities pursuant to SEC Category 1 framework. Empire Stock Transfer is not affiliated with OTCM Protocol, Inc.