🏆 COMPETITIVE ANALYSIS (SECURITIZE vs. OTCM PROTOCOL)

🎙️ PRESENTATION

📊 Competitive Analysis: Securitize vs. OTCM Protocol

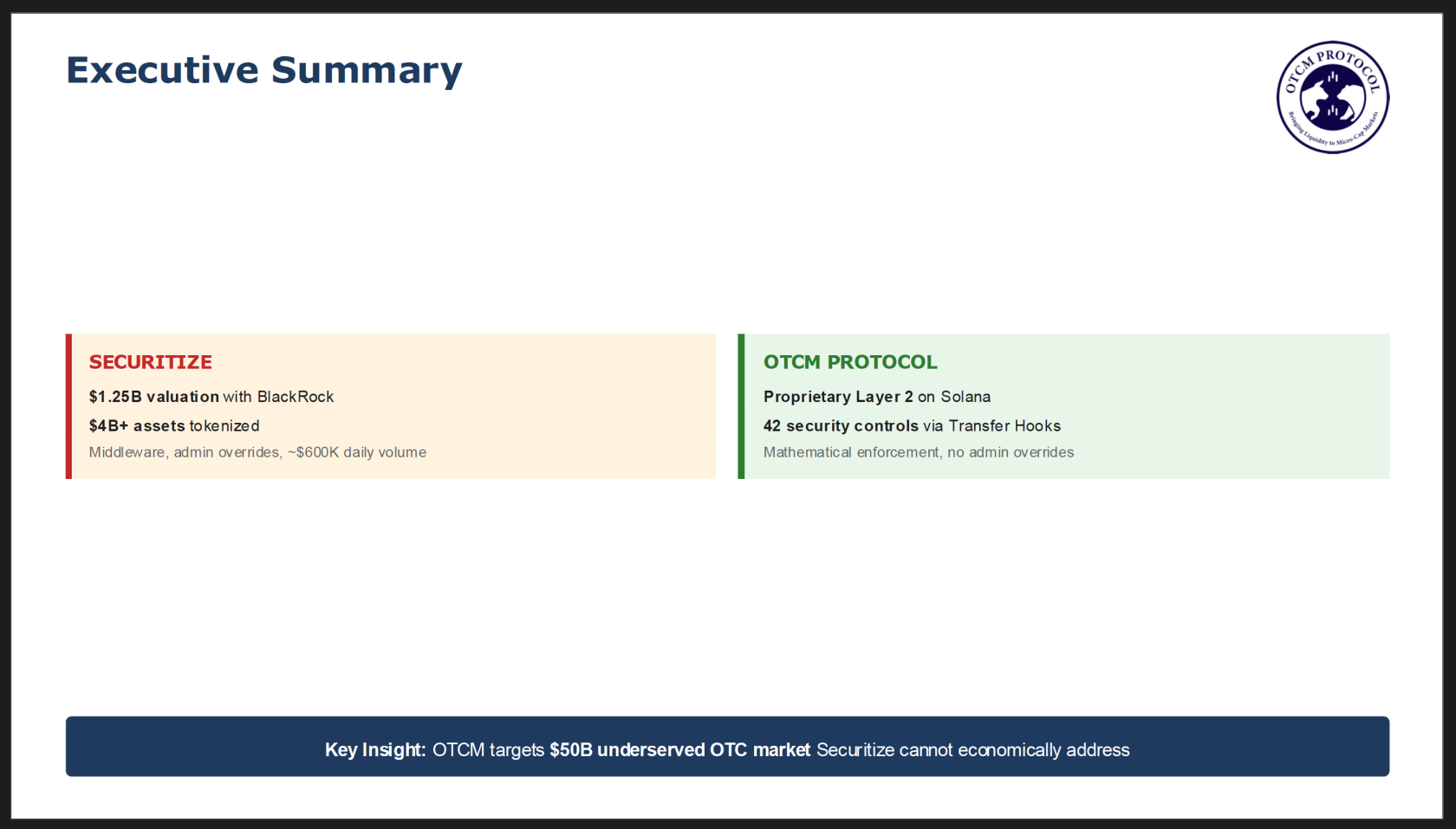

📋 Executive Summary

BlackRock's tokenization partner Securitize dominates institutional digital securities with more than $4 billion in assets tokenized and a $1.25 billion valuation. However, its middleware-on-public-chains architecture, centralized compliance overrides, and limited secondary liquidity reveal structural vulnerabilities that create opportunities for alternative approaches.

OTCM Protocol offers a fundamentally different model built on complete Layer 2 infrastructure control, mathematically-enforced security via Solana Token-2022 (ST22), and permanent liquidity mechanisms. This architecture positions OTCM Protocol to capture the underserved $50 billion illiquid OTC securities market that Securitize's institutional model cannot economically address.

🏛️ Part I: Securitize Profile

🏢 Company Overview and Institutional Dominance

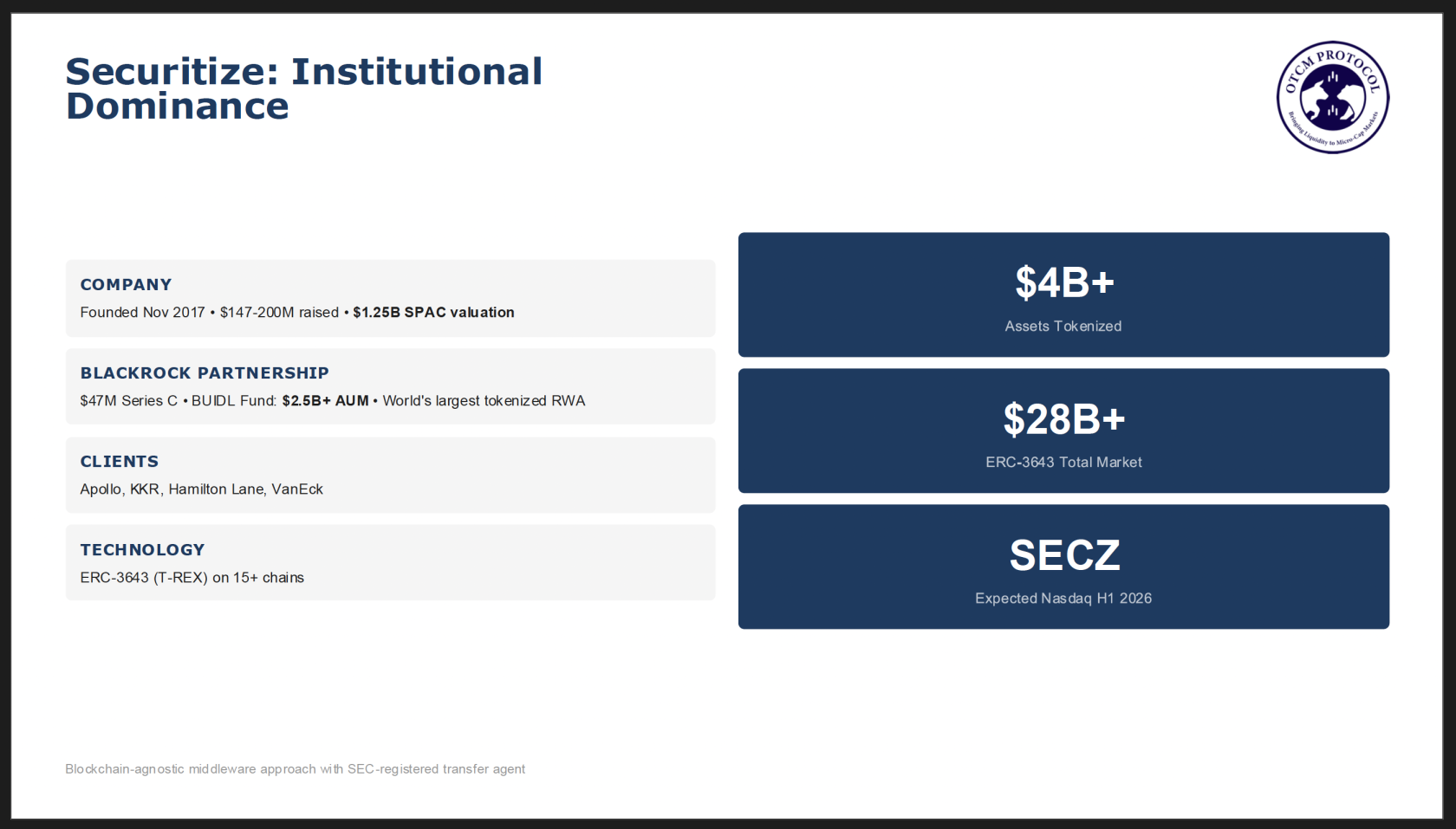

Securitize was founded in November 2017 by Carlos Domingo and Jamie Finn to serve as a bridge between Wall Street and blockchain-based securities. The company raised approximately $147-200 million across funding rounds, with a pivotal $47 million Series C in May 2024 led by BlackRock. This investment placed Joseph Chalom, BlackRock's Global Head of Strategic Ecosystem Partnerships, on Securitize's board, cementing the institutional relationship that defines the company's market position.

In October 2025, Securitize announced a SPAC merger with Cantor Equity Partners II at a $1.25 billion pre-money valuation, with an expected Nasdaq listing under ticker SECZ in the first half of 2026. This public market debut will provide significant capital for expansion while validating the company's institutional-focused strategy.

The BlackRock relationship represents Securitize's crown jewel. The BUIDL fund (BlackRock USD Institutional Digital Liquidity Fund), launched in March 2024, has grown to more than $2.5 billion in assets under management, making it the world's largest tokenized real-world asset. Beyond BlackRock, Securitize counts Apollo, KKR, Hamilton Lane, and VanEck as institutional clients, establishing an impressive roster of traditional finance partnerships that few competitors can match.

📜 Regulatory Positioning: The Issuer-Sponsored Model

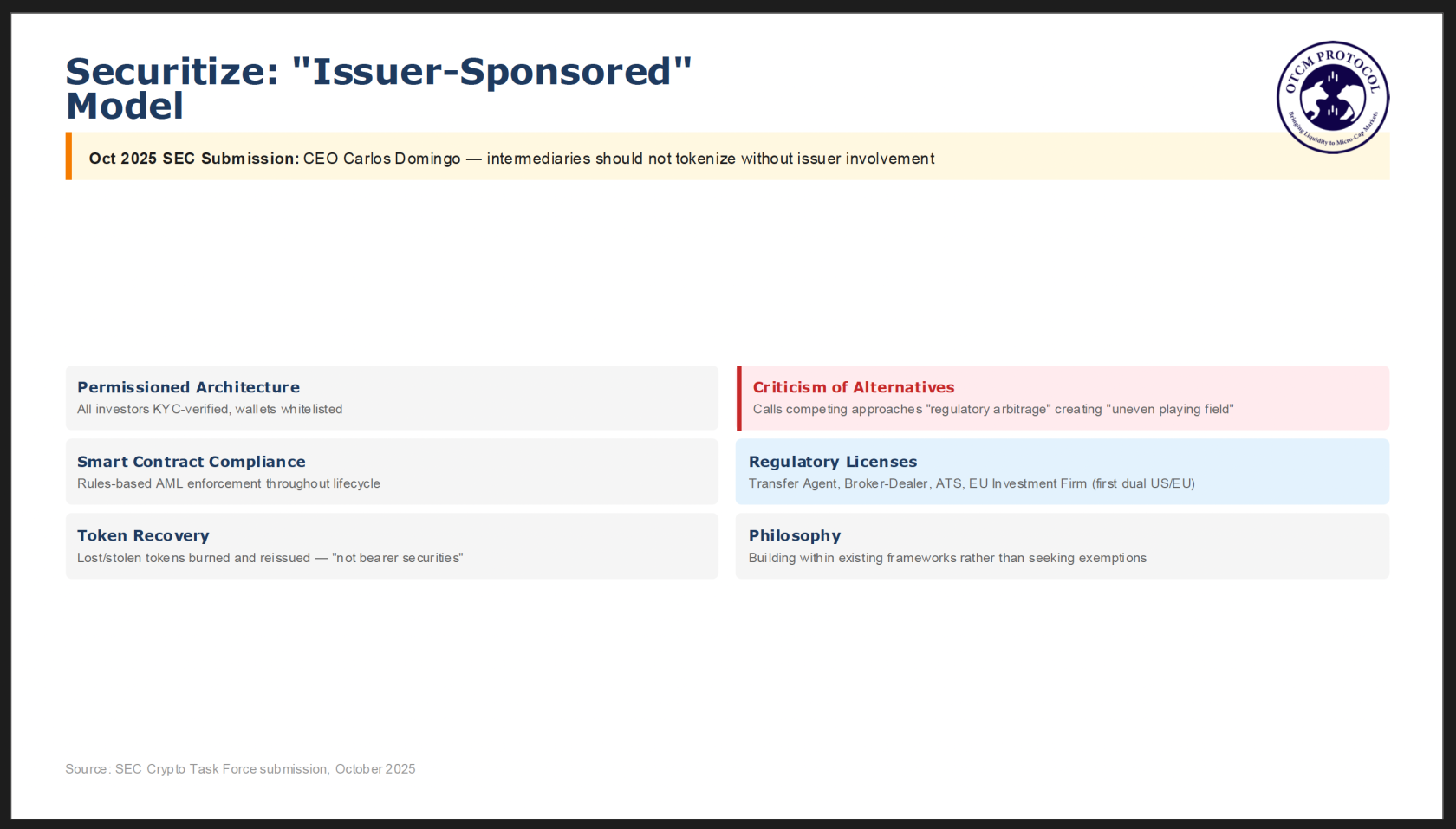

In Securitize's October 2025 submission to the SEC Crypto Task Force, CEO Carlos Domingo articulated a clear regulatory philosophy that defines the company's approach to tokenization. Securitize characterizes its model as "issuer-sponsored" tokenization, arguing that intermediaries should not tokenize public equity without the issuer's direct involvement and assent. The company's SEC-registered digital transfer agent works directly with issuers to "natively" mint tokenized securities without intermediary layers.

This regulatory positioning encompasses several key elements:

- ✅ All investors are KYC-verified and wallets are whitelisted before any transaction can occur, creating a permissioned architecture that satisfies traditional compliance requirements

- ✅ Rules-based smart contracts enforce lawful transfers and AML compliance throughout the asset lifecycle

- ✅ The platform includes token recovery capabilities, allowing lost, stolen, or impaired tokens to be burned and reissued by the transfer agent

- ✅ Securitize explicitly emphasizes that these are "not bearer securities"

Notably, Securitize's SEC submission explicitly characterizes competing approaches, including permissionless wrapped tokens and derivative securities, as "regulatory arbitrage" that creates "an uneven playing field" for compliant ecosystem participants. This positioning reflects Securitize's institutional DNA and its strategy of building within existing frameworks rather than seeking exemptions. However, it also reveals a fundamental philosophical difference with platforms serving markets that traditional infrastructure has abandoned.

🔧 Technology Architecture: Middleware on Public Chains

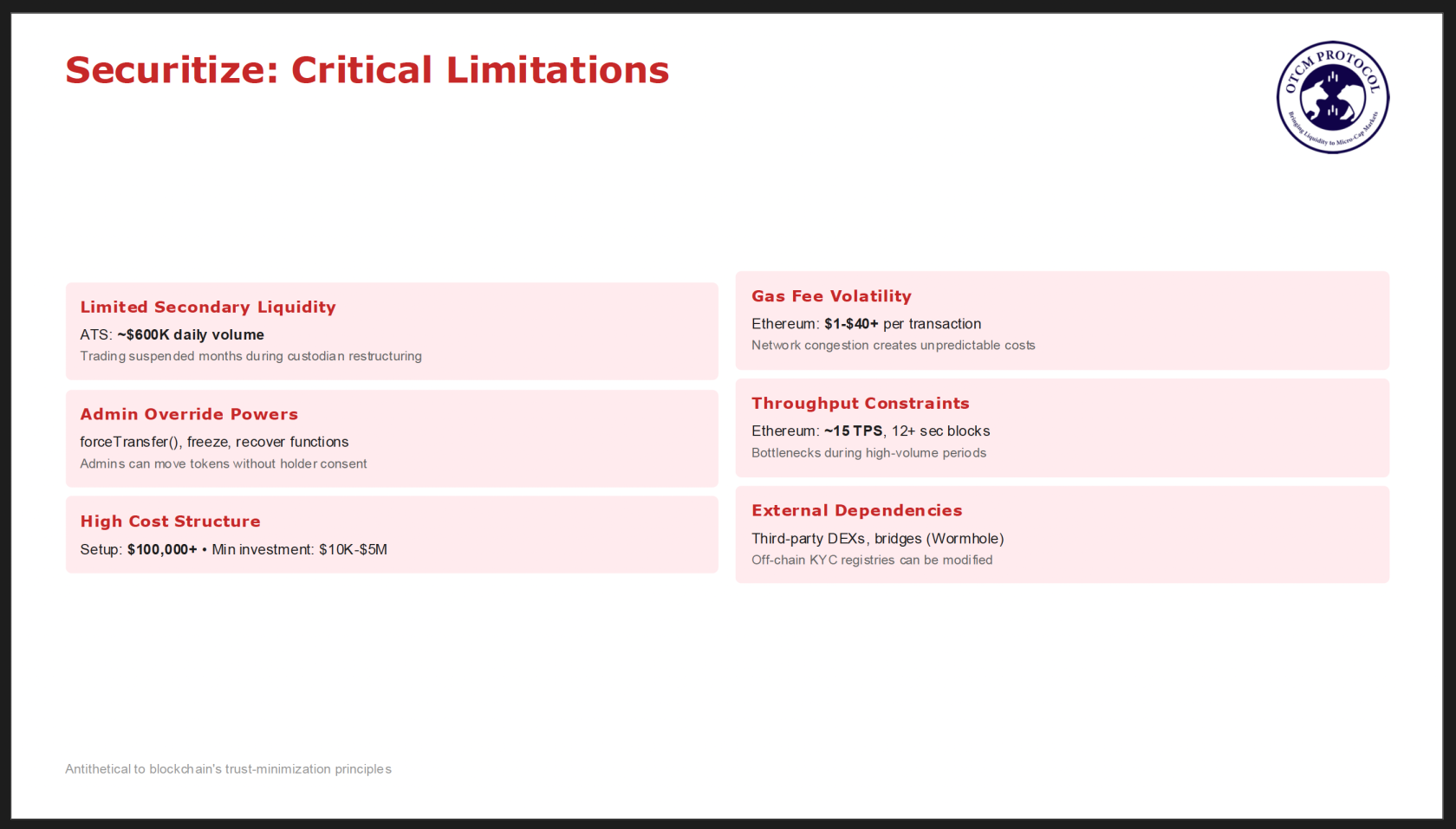

Securitize operates as blockchain-agnostic middleware, deploying the ERC-3643 (T-REX) token standard across more than 15 public blockchains including Ethereum, Polygon, Avalanche, and Solana. While this multi-chain approach provides flexibility, Securitize runs no blockchain infrastructure of its own. This architectural choice means the platform inherits the limitations of general-purpose chains, including gas fee volatility, scalability constraints, and computational limits on complex compliance rules.

The company operates with an SEC-registered transfer agent for custody and shareholder services, providing the institutional-grade infrastructure that its client base requires.

⚠️ Critical Limitations

Despite its market position, Securitize faces several structural limitations:

- 📉

📑LimitedDETAILLiquidity:ANALYSISSecuritize Markets ATS reports daily trading volume of approximately $600,000, a modest figure for a platform claiming market leadership - ⏸️ Trading Disruptions: User complaints describe trading suspended for months due to custodian restructuring, revealing operational dependencies that can disrupt investor access

- 👤 Admin Overrides: The ERC-3643 standard includes administrative override powers such as force transfer, freeze, and recovery functions that allow administrators to override on-chain ownership. While these capabilities provide flexibility for compliance and error correction, they are antithetical to blockchain's trust-minimization principles and create centralization risks

- 💸 High Costs: The platform's cost structure also limits its addressable market. Setup fees exceeding $100,000 and minimum investments ranging from $10,000 to $5,000,000 exclude smaller issuers and retail investors

🟢 Part II: OTCM Protocol Advantages

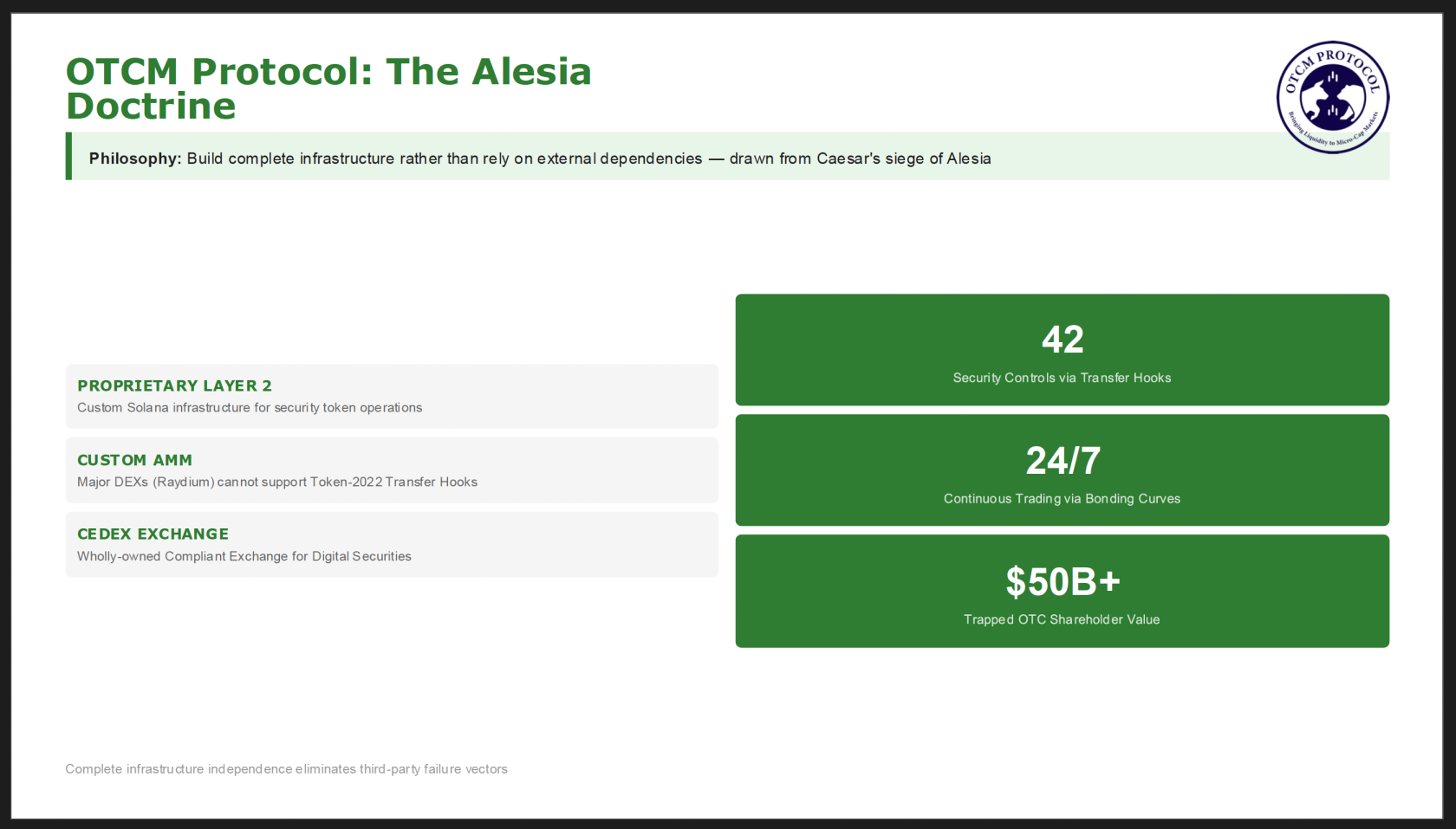

🏰 The Alesia Doctrine: Complete Infrastructure Control

OTCM Protocol's architecture reflects a strategic philosophy drawn from Caesar's siege of Alesia: build complete defensive infrastructure rather than rely on external dependencies. Where Securitize deploys on public chains it does not control, OTCM Protocol builds proprietary Layer 2 infrastructure on Solana specifically designed for security token operations.

This architectural decision emerged from a critical discovery during development. Major decentralized exchanges like Raydium cannot support Token-2022 Transfer Hooks, meaning that tokens traded on these platforms would lose their security controls. Rather than compromise security to fit existing infrastructure, OTCM Protocol builds custom AMM functionality that preserves all 42 security controls on every transaction.

OTCM Protocol's implementation of Solana's Token-2022 program, designated Security Token 2022 (ST22), represents a fundamentally different approach to compliance enforcement than Securitize's ERC-3643. The company works with an SEC-registered transfer agent to provide custody and shareholder services for tokenized securities on the platform.

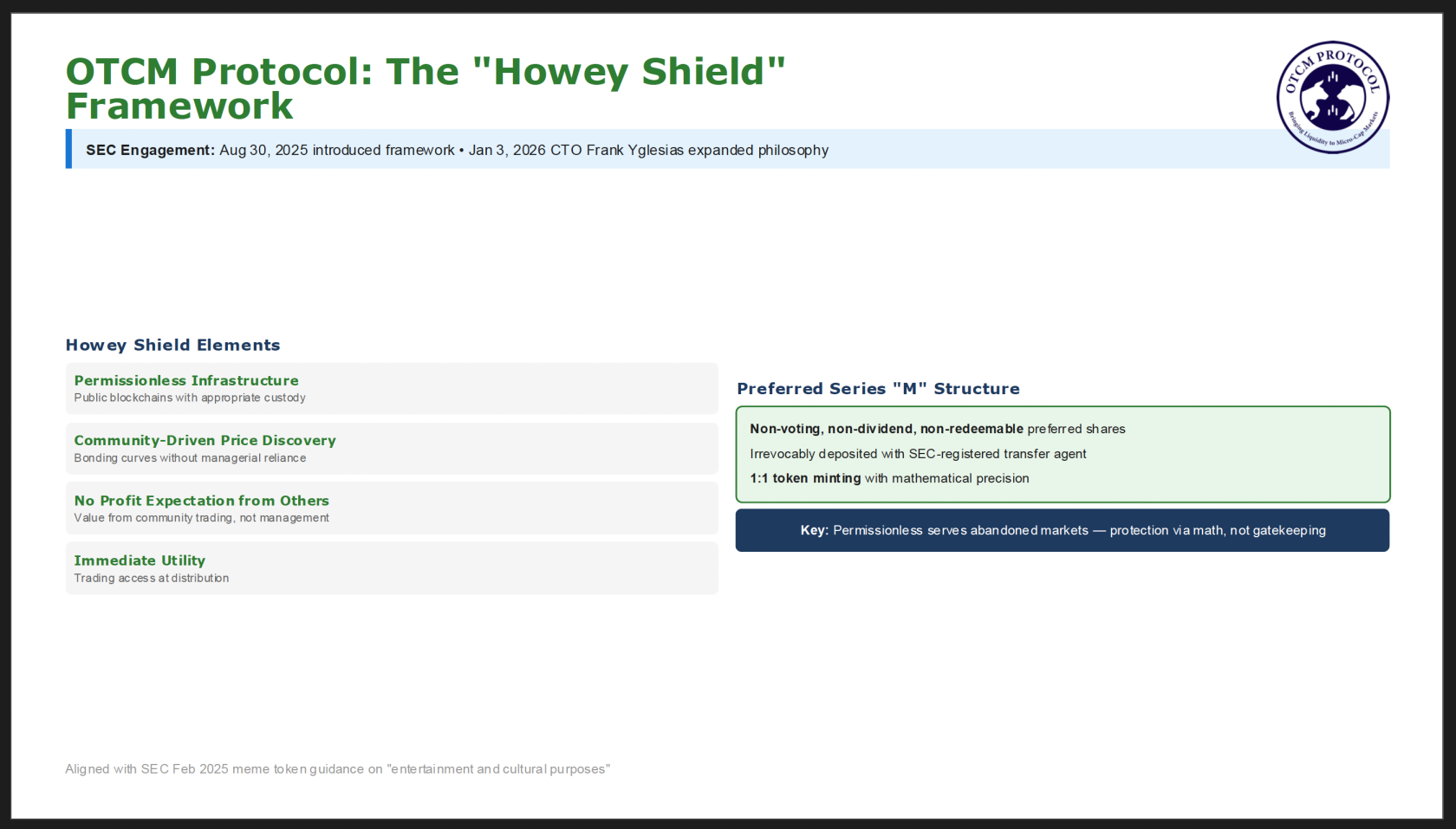

🛡️ Regulatory Positioning: The Howey Shield Framework

OTCM Protocol has demonstrated consistent regulatory engagement with the SEC Crypto Task Force through multiple submissions. In the company's August 30, 2025 submission, OTCM first introduced the "Howey Shield" framework, proposing it as a regulatory template for future safe harbor provisions. This submission demonstrated how asset-backed, entertainment-purposed tokens can operate within existing legal frameworks while revitalizing illiquid markets.

In OTCM Protocol's January 3, 2026 submission to the SEC Crypto Task Force, CTO Frank Yglesias expanded on this regulatory philosophy, articulating a fundamentally different approach than Securitize's permissioned model. The Howey Shield framework structures ST22 Security Tokens as meme tokens under the SEC's February 2025 guidance, which recognized that tokens serving "entertainment and cultural purposes" with community-driven pricing do not constitute securities under the Howey test.

The framework rests on several key elements:

- 🌐 Permissionless Infrastructure: OTCM advocates for permissionless infrastructure, arguing that public, permissionless blockchain systems are consistent with investor protection when paired with appropriate custody arrangements

- 📈 Community-Driven Price Discovery: Bonding curves provide community-driven price discovery through algorithmic pricing without reliance on managerial efforts, a key factor in failing the Howey investment contract analysis

- 🚫 No Profit Expectation: Token value derives from community trading activity and market dynamics rather than promises of managerial performance, eliminating the expectation of profits from others' efforts

- ⚡ Immediate Utility: Tokens provide trading access immediately upon distribution, creating immediate utility that avoids the "investment" characterization

OTCM's tokenization model utilizes a novel Preferred Series "M" share mechanism. Companies create special non-voting, non-dividend, non-redeemable preferred shares specifically designed for tokenization. These shares are irrevocably deposited with an SEC-registered transfer agent under permanent custody arrangements, and for each deposited share, exactly one ST22 Security Token is minted with mathematical precision. This structure creates permanent separation between tokens and underlying securities while maintaining 1:1 asset backing.

This regulatory positioning reflects a fundamentally different philosophy than Securitize's issuer-sponsored model. Where Securitize argues that only permissioned, issuer-sanctioned tokenization is legitimate, OTCM argues that permissionless infrastructure can serve markets that traditional finance has abandoned, providing investor protection through mathematical security controls rather than centralized gatekeeping.

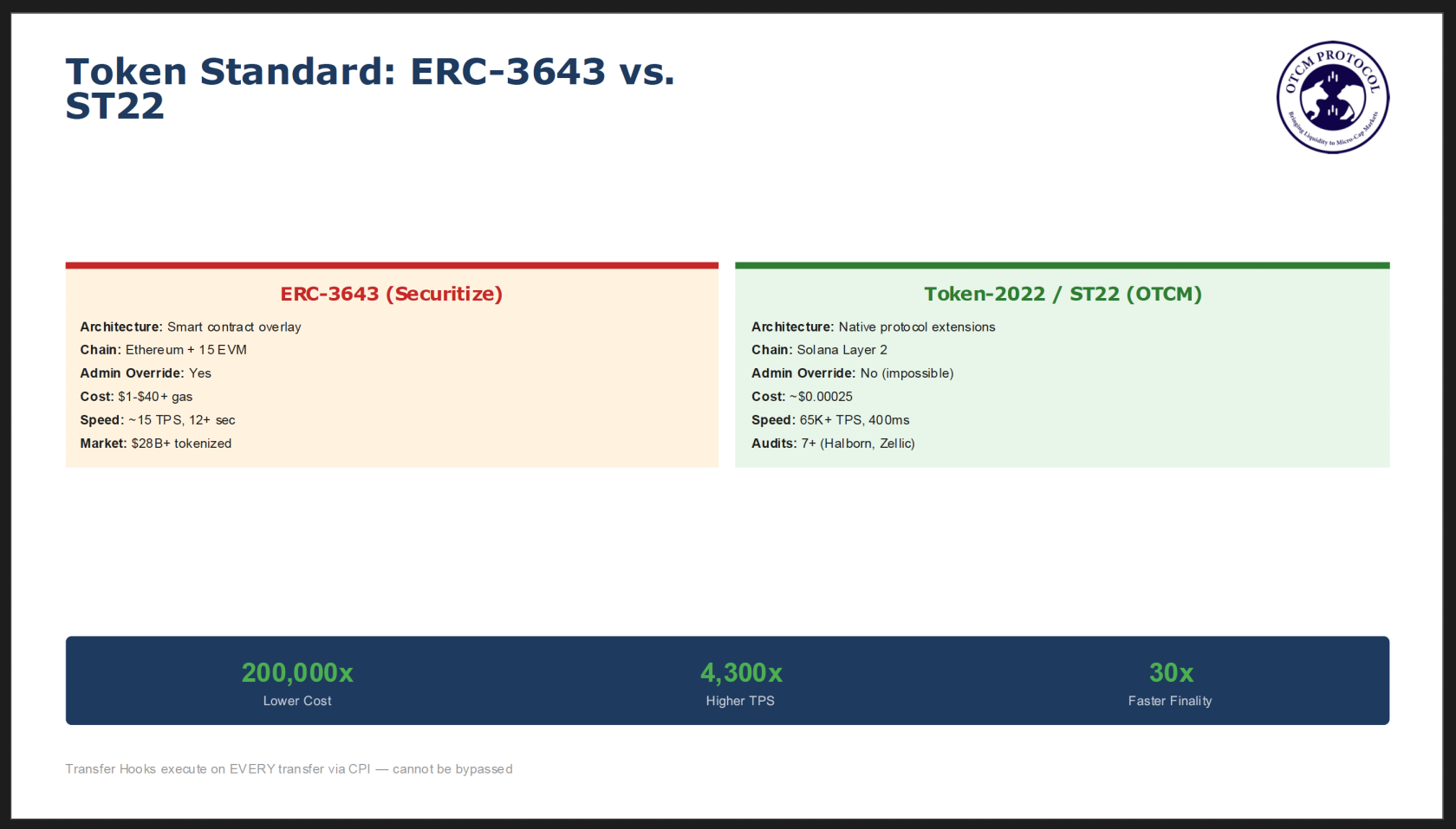

⚖️ Token Standard Architecture: ERC-3643 vs. Token-2022 (ST22)

Beyond custody and business model differences, Securitize and OTCM Protocol employ fundamentally different token standards that determine how compliance is enforced at the protocol level. This architectural choice has profound implications for security, scalability, and transaction economics.

🔴 Securitize: ERC-3643 on Ethereum

Securitize builds on the ERC-3643 standard, formerly known as T-REX (Token for Regulated EXchanges), an open-source suite of smart contracts that extends ERC-20 with compliance functionality. Developed by Tokeny Solutions and now governed by the ERC-3643 Association, more than $28 billion in assets have been tokenized using ERC-3643, making it the dominant standard for institutional security tokens on Ethereum and EVM chains.

The ERC-3643 architecture consists of several interconnected components:

- 🔧 Smart Contract Overlay: Adds compliance functionality on top of standard ERC-20 tokens through additional smart contracts

- 🆔 ONCHAINID: Provides a decentralized identity system based on ERC-734/735, storing keys and verifiable claims for each investor

- 📋 Identity Registry: Maintains mapping between wallet addresses and verified identities

- ✅ Compliance Service: Offers modular rules engine checking transfer eligibility before execution

- 🏛️ Trusted Issuers Registry: Contains the list of approved claim issuers such as KYC providers and accreditation verifiers

However, ERC-3643 carries structural limitations:

- 👤 Admin Overrides: The standard includes administrative override powers through functions like

forceTransfer(),freezePartialTokens(), andrecoveryAddress(), allowing administrators to move tokens without holder consent - ⚠️ Registry Manipulation Risk: Compliance depends on off-chain identity registries that can be modified

- ⛽ Gas Volatility: Ethereum transaction fees have historically ranged from $1 to more than $40 during network congestion

- 🐢 Throughput Constraints: Ethereum processes approximately 15 transactions per second, creating bottlenecks during high-volume periods

- 🔗 Off-chain KYC Dependency: Identity verification happens off-chain with only attestations stored on-chain

🟢 OTCM Protocol: Security Token 2022 on Solana

OTCM Protocol builds on Solana's Token-2022 program, also called Token Extensions, a native upgrade to Solana's SPL token standard that embeds compliance functionality directly into the protocol layer. Unlike ERC-3643's smart contract overlay approach, Token-2022 extensions are executed by the Token Extensions program itself rather than by external smart contracts.

The Token-2022 architecture provides:

- ⚙️ Native Protocol Extensions: Compliance features built directly into Solana's token program

- 🔗 Transfer Hooks: Enable custom instruction logic that executes on every token transfer via Cross Program Invocation (CPI), and this execution cannot be bypassed or disabled

- 🔐 Atomic Enforcement: The Token Extensions program itself enforces Transfer Hook execution, not external validators

- 🛡️ Signer Privilege Isolation: By design, the sender's signer privileges do not extend to the Transfer Hook program, preventing malicious exploitation

- 🔧 Composable Extensions: Multiple extensions can be combined, including transfer fees, confidential transfers, permanent delegation, and metadata

- 🔒 Immutability: Mint extensions must be applied during initialization and cannot be changed afterward

Token-2022 offers significant advantages over Ethereum-based alternatives:

Advantage | Details |

|---|---|

💰 Ultra-Low Costs | Typical Solana transaction costs approximately $0.00025, enabling micro-transactions and high-frequency trading |

⚡ Massive Throughput | Solana processes more than 65,000 transactions per second theoretically, with practical high throughput for real-world applications |

🚀 Near-Instant Finality | Transaction confirmation occurs in approximately 400 milliseconds, compared to Ethereum's 12+ second block times |

🔐 Mathematical Enforcement | Transfer Hooks execute automatically with mathematical enforcement that no administrator can bypass |

🔍 Extensive Audits | The platform has completed more than seven security audits by firms including Halborn, Zellic, NCC, Trail of Bits, OtterSec, and Certora |

🏛️ Institutional Adoption | Players including Paxos (USDP stablecoin), GMO Trust, and major RWA protocols are launching on Token-2022 |

📊 Token Standard Comparison Table

Dimension | ERC-3643 (Securitize) | Token-2022 / ST22 (OTCM) |

|---|---|---|

⛓️ Blockchain | Ethereum + EVM chains (15+) | Solana (dedicated Layer 2) |

🏗️ Architecture | Smart contract overlay on ERC-20 | Native protocol-level extensions |

📋 Compliance Model | Off-chain registry lookups | On-chain Transfer Hook enforcement |

👤 Admin Override | Yes (forceTransfer, freeze, recover) | No—mathematically impossible |

💸 Transaction Cost | $1-40+ gas fees | ~$0.00025 per transaction |

⚡ Transaction Speed | ~15 TPS, 12+ sec blocks | 65,000+ TPS, 400ms finality |

🆔 Identity System | ONCHAINID (ERC-734/735) | Transfer Hook validation |

📊 Market Adoption | $28B+ tokenized | Emerging institutional adoption |

🔍 Security Audits | Multiple (Tokeny ecosystem) | 7+ audits (Halborn, Zellic, etc.) Token-2022 Solana |

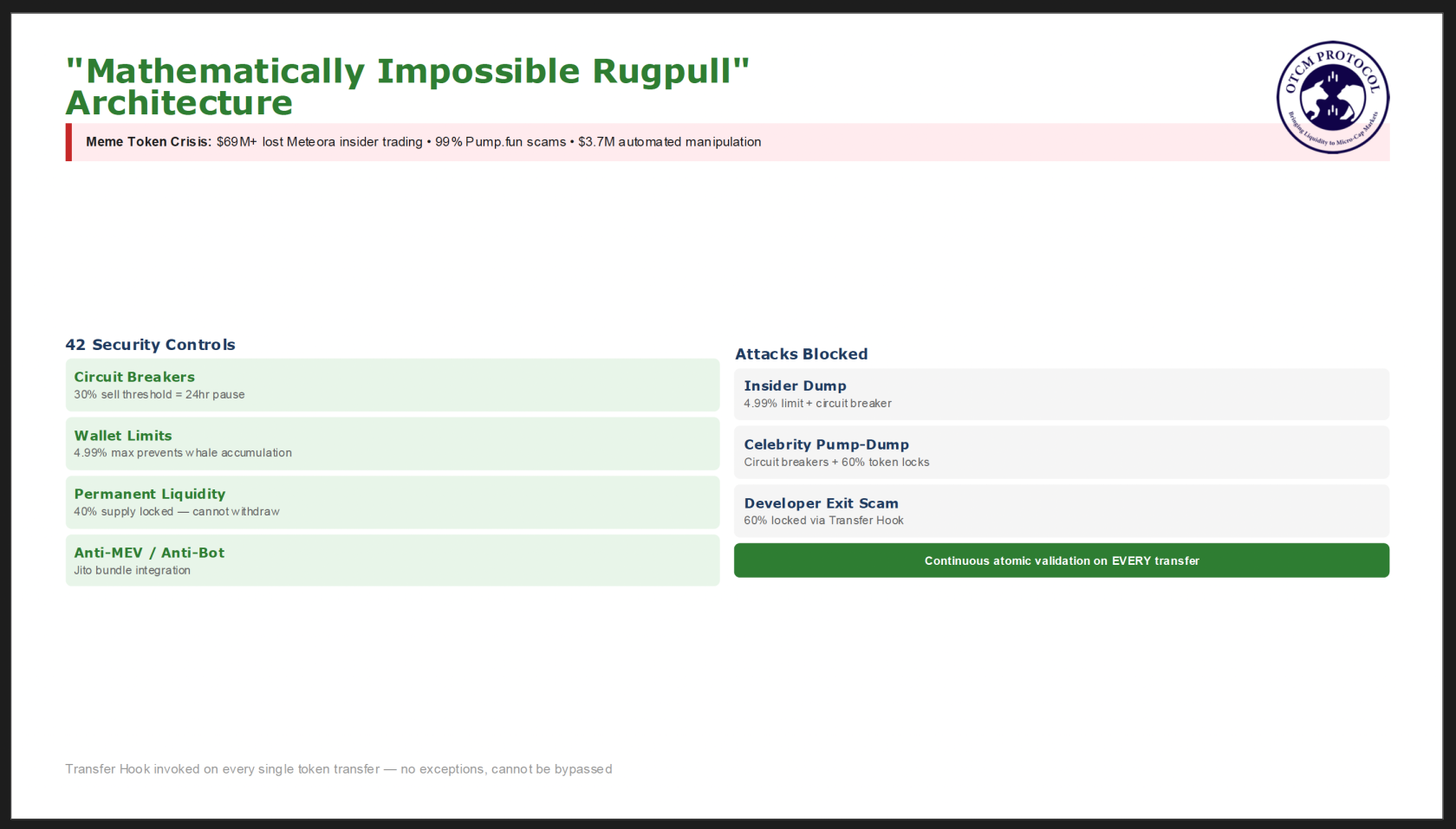

⚠️ The Meme Token Crisis: Why These Controls Matter

OTCM Protocol's SEC submission documents the systemic fraud plaguing the broader meme token ecosystem, providing context for why its security architecture addresses a genuine market need.

The scale of losses is substantial:

- 💸 More than $69 million was lost to insider trading on Meteora from December 2024 to February 2025

- 🚨 Analysis confirmed that 99% of tokens on Pump.fun were scams, with 18,000 fake tokens created by a single user

- 🤖 Automated manipulation schemes stole $3.7 million

- ⚠️ Traditional meme token platforms charge $2-5 to launch with no audit, no limits, and no accountability, creating a billion-dollar fraud ecosystem that harms retail investors

🛡️ OTCM Protocol's ST22 Implementation

OTCM Protocol leverages Token-2022 Transfer Hooks to implement 42 distinct security controls that execute on every transaction:

- 🔒 Permanent Liquidity Locks: Make rugpulls mathematically impossible

- 🔴 Circuit Breakers: Trigger automatic halts when the 30% sell threshold is reached

- 📊 Wallet Limits: Enforce maximum holdings of 4.99% programmatically

- 🤖 Anti-Bot Protection: Prevent automated manipulation

- ⚡ Front-Running Prevention: Block sandwich attacks

- ✅ Comprehensive Compliance Verification: Ensure regulatory requirements are met

Unlike ERC-3643 where these would be policy promises subject to admin override, on OTCM Protocol they are mathematical certainties enforced at the protocol level.

OTCM's SEC submission describes this as a "mathematically impossible rugpull" architecture. The Transfer Hook program is invoked on every single token transfer without exception. This is not periodic monitoring or sampling but continuous, atomic validation that cannot be bypassed.

Real attack scenarios that devastate traditional meme tokens become mathematically impossible under this architecture:

Attack | OTCM Protection |

|---|---|

💣 Insider Dump | Blocked by 4.99% wallet limits |

⭐ Celebrity Pump-and-Dump | Trigger circuit breakers |

🚪 Developer Exit Scams | Prevented by 60% token locks with vesting enforcement |

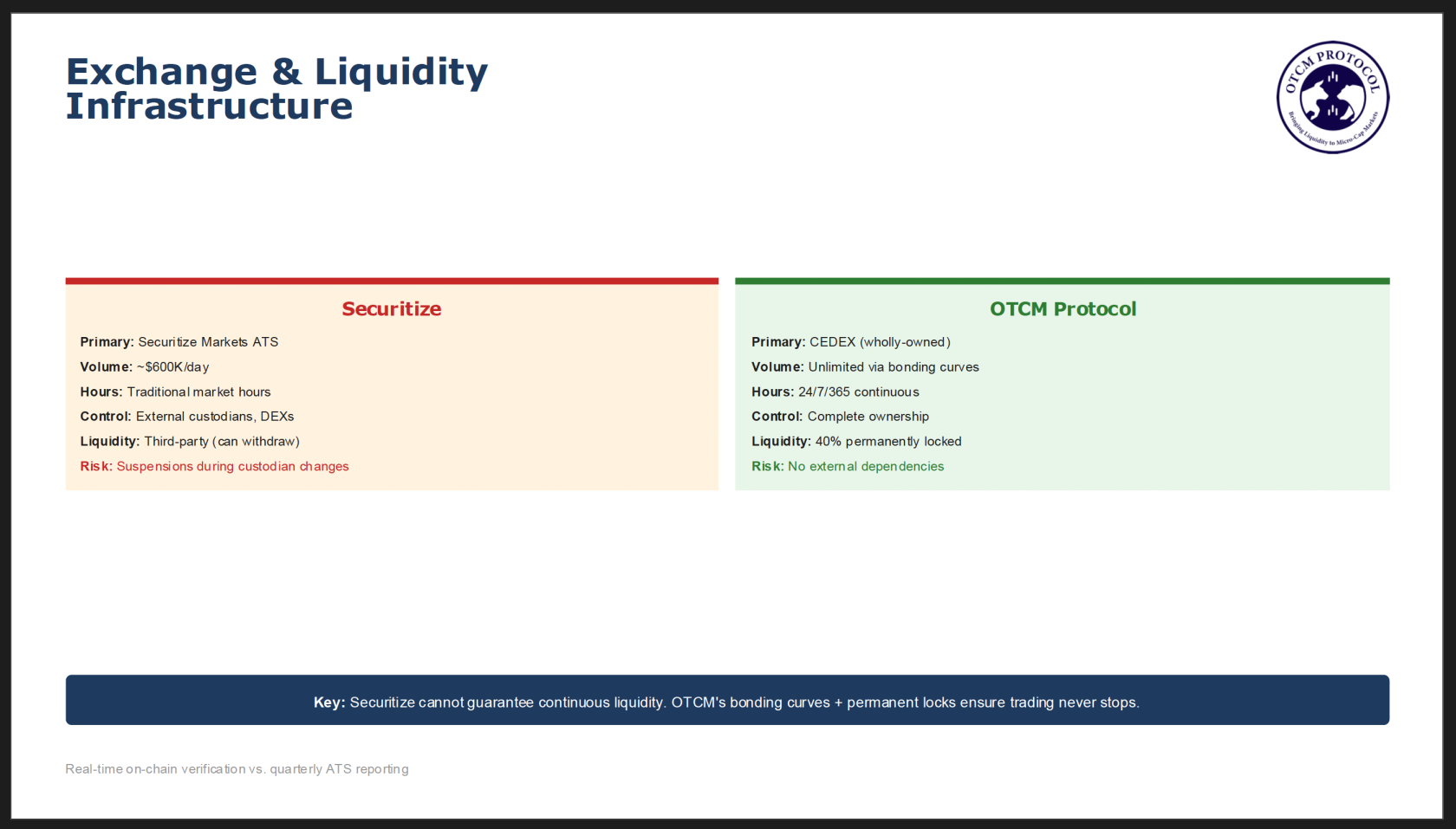

🏦 Exchange and Liquidity Infrastructure: Dependencies vs. Ownership

A critical distinction between Securitize and OTCM Protocol lies in their approach to trading infrastructure. Securitize depends on external exchanges and third-party liquidity providers, creating operational dependencies that can disrupt trading. OTCM Protocol owns and operates its proprietary CEDEX exchange with open liquidity pools, ensuring permanent, uninterrupted market access aligned with the Alesia Doctrine's mandate for complete infrastructure control.

🔴 Securitize: Dependent on External Exchange Infrastructure

Securitize operates Securitize Markets, an SEC-registered Alternative Trading System (ATS), as its primary secondary trading venue. However, this infrastructure faces significant limitations that constrain liquidity and create operational risks:

- 📉 Limited Volume: Securitize Markets reports approximately $600,000 in daily trading volume, a modest figure for a platform claiming institutional leadership

- ⏰ Limited Hours: The ATS operates during traditional market hours, limiting global investor access and preventing 24/7 liquidity

- ⏸️ Trading Suspensions: User reports indicate trading suspensions lasting months during custodian restructuring events, representing infrastructure outside Securitize's control

- 🔗 External Dependencies: For broader liquidity, Securitize relies on external decentralized exchanges and bridges like Wormhole that introduce additional counterparty and smart contract risk

- 🚫 Limited Retail Access: Primary distribution through private placements limits retail participation and creates illiquid secondary markets

- ⚠️ Withdrawal Risk: Market making and liquidity provision depend on third-party relationships that can be withdrawn, modified, or disrupted

This dependency architecture means Securitize cannot guarantee continuous liquidity. When external partners experience technical issues, regulatory changes, or business decisions affecting their services, Securitize token holders bear the consequences through suspended trading or reduced market access.

🟢 OTCM Protocol: Proprietary CEDEX Exchange and Open Liquidity Pools

OTCM Protocol takes the opposite approach, building and operating its own Compliant Exchange for Digital Securities (CEDEX) with integrated open liquidity pools. This proprietary infrastructure ensures that trading can never be disrupted by external dependencies.

CEDEX Features:

- ✅ Complete Ownership: CEDEX is wholly owned and operated by OTCM Protocol, eliminating external dependencies that can disrupt trading

- ⏰ 24/7/365 Operation: Unlike traditional ATS venues, CEDEX operates continuously, enabling global investor participation across all time zones

- 🔐 Integrated Compliance: Token-2022 Transfer Hooks enforce all 42 security controls directly within the exchange, ensuring every trade meets compliance requirements

- 🔧 Custom AMM Infrastructure: Built specifically to support Token-2022 Transfer Hooks that external DEXs like Raydium cannot accommodate

Open Liquidity Pool Architecture:

- 📈 Algorithmic Pricing: Bonding curve mechanisms deliver continuous liquidity without requiring traditional market makers

- 🔒 Permanent Liquidity Locks: 40% of Security Meme Token supply is locked in liquidity pools permanently, making withdrawal or rugpull mathematically impossible

- 🌐 Open Participation: Any qualified holder can provide liquidity and earn proportional fees, democratizing market making

- 👁️ Transparent Pool Reserves: All liquidity pool balances are verifiable on-chain in real-time, ensuring complete transparency

- 🏦 Protocol-Owned Liquidity: OTCM Protocol itself maintains significant liquidity positions, ensuring baseline market depth regardless of external participation

📊 Exchange and Liquidity Infrastructure Comparison

Dimension | Securitize | OTCM Protocol |

|---|---|---|

🏛️ Primary Exchange | Securitize Markets ATS (SEC-registered) | CEDEX (proprietary, wholly-owned) |

🔗 Infrastructure Control | Dependent on external custodians, bridges, DEXs | Complete ownership per Alesia Doctrine |

⏰ Trading Hours | Traditional market hours | 24/7/365 continuous operation |

📊 Daily Volume | ~$600K/day ATS volume | Unlimited via bonding curves |

💧 Liquidity Model | Third-party market makers, external LPs | Open liquidity pools + protocol-owned liquidity |

🔒 Liquidity Permanence | Can be withdrawn by providers | 40% permanently locked—cannot be withdrawn |

📈 Pricing Mechanism | Order book matching | Algorithmic bonding curves |

⚠️ Trading Disruption Risk | Suspensions reported during custodian changes | No external dependencies to cause disruption |

👁️ Transparency | Quarterly reporting via ATS filings | Real-time on-chain pool verification |

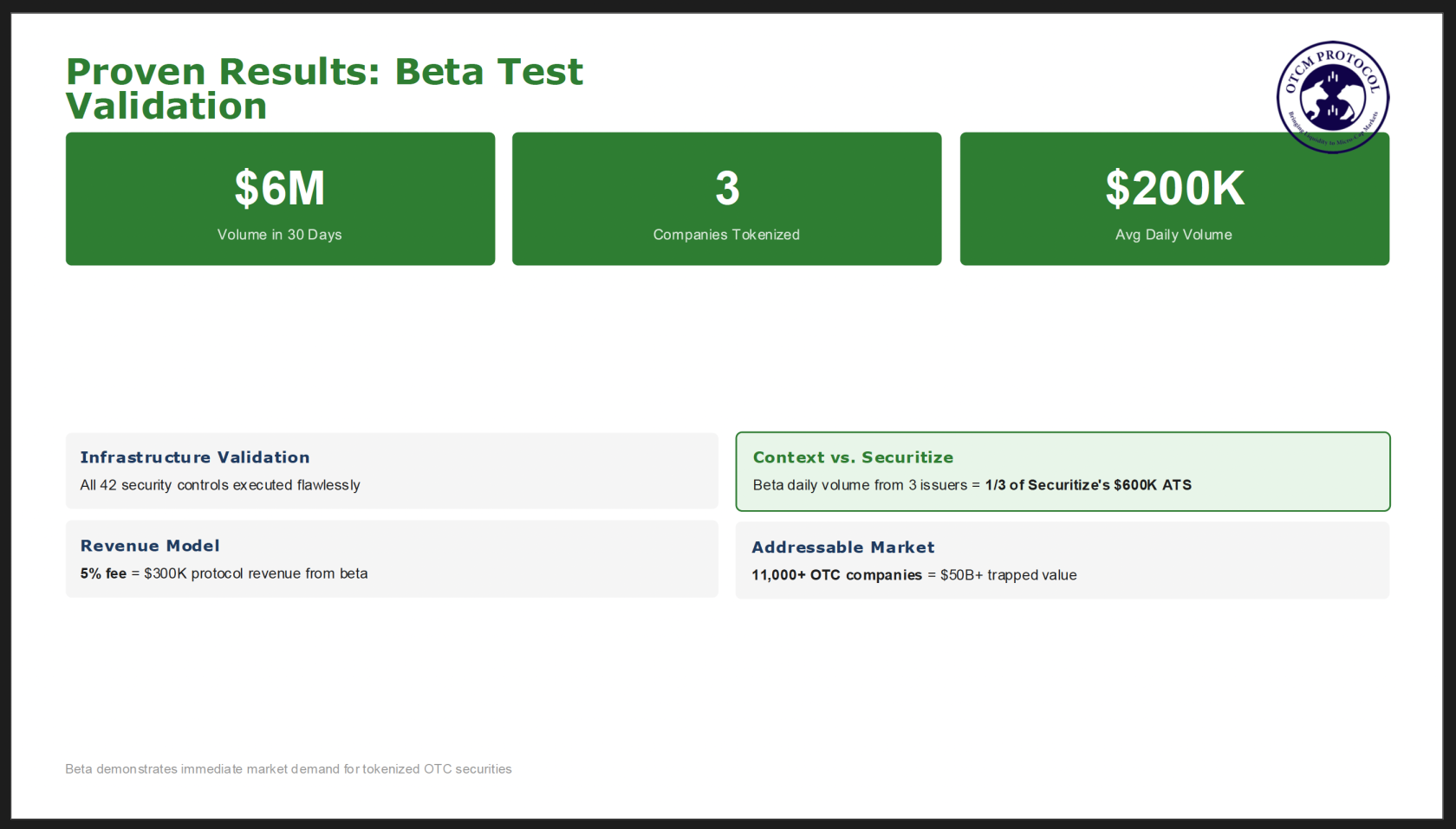

✅ Proven Results: Beta Test Validation

OTCM Protocol's infrastructure has already demonstrated real-world performance through a successful beta test program that validates both the technology and the market demand for tokenized OTC securities.

Beta Test Results:

- 🏢 Three public companies tokenized their securities through OTCM Protocol during the beta test

- 💰 The program generated $6 million in trading volume within 30 days, demonstrating immediate market demand for tokenized OTC securities

- 📊 Average daily volume reached $200,000 across just three issuers, already approaching one-third of Securitize's reported approximately $600,000 daily ATS volume

- ✅ All 42 security controls executed flawlessly on every transaction, proving the Token-2022 Transfer Hook architecture at scale

OTCM Protocol generates revenue through a 5% fee on all trades executed through CEDEX and the open liquidity pools. This fee structure creates substantial revenue potential as trading volume scales across the ecosystem. Using the beta test as a baseline, the $6 million in 30-day volume generated $300,000 in protocol revenue from just three issuers. Extrapolating this across hundreds or thousands of tokenized companies reveals the magnitude of the opportunity.

The OTC Markets ecosystem includes over 11,000 companies across Pink, OTCQB, and OTCQX tiers, each representing potential tokenization opportunities for OTCM Protocol. Many of these companies and their shareholders suffer from limited liquidity, restricted trading access, and the inability to efficiently price and transfer ownership. OTCM Protocol's issuer-friendly economics, with setup costs of $600-$10,000 compared to $100,000+ for enterprise alternatives, make tokenization accessible to the vast majority of this market that institutional platforms like Securitize cannot economically serve.

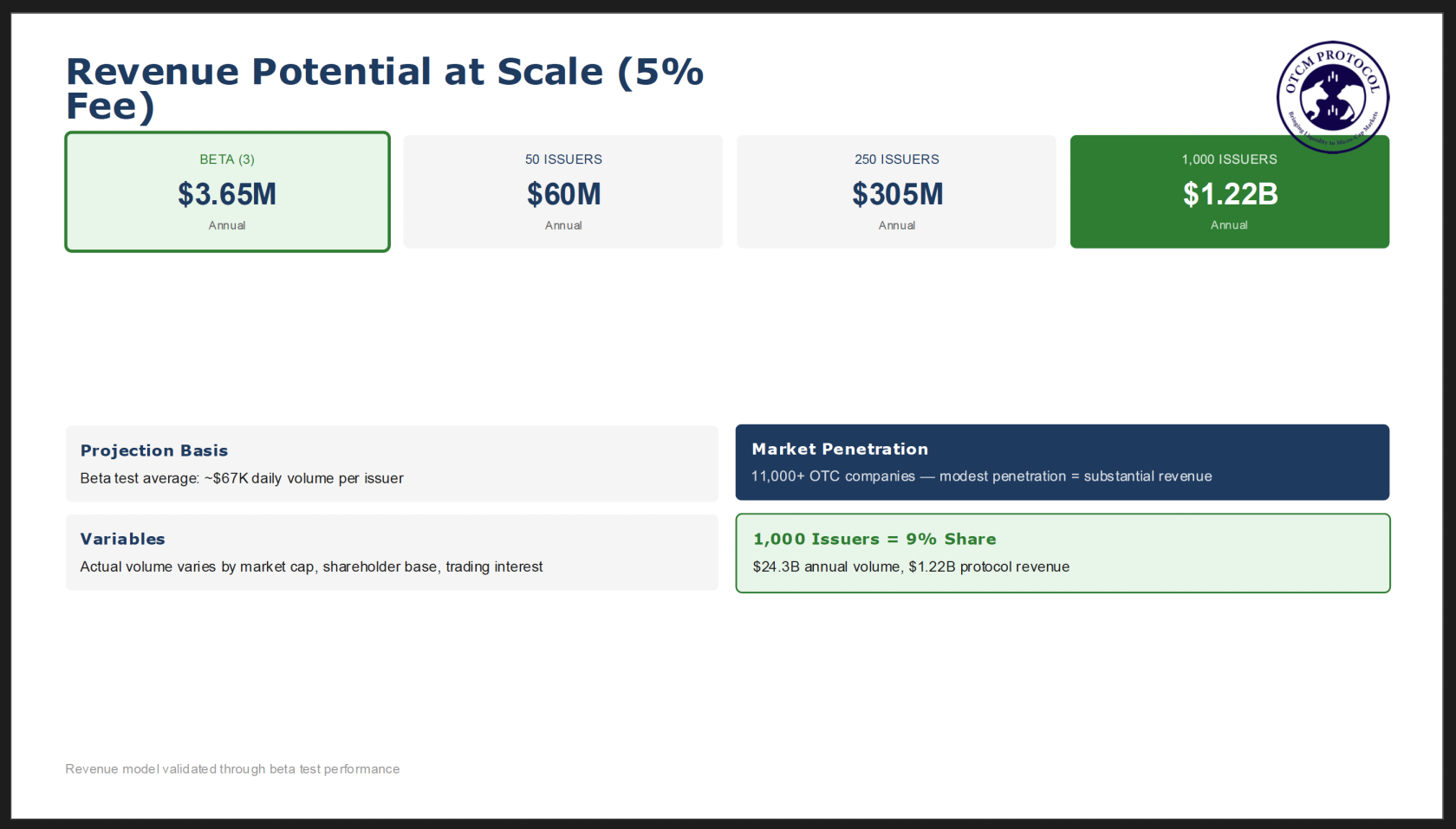

💰 Revenue Potential at Scale

Tokenized Issuers | Daily Volume (est.) | Annual Volume | Annual Protocol Revenue (5%) |

|---|---|---|---|

3 (Beta) | $200K | $73M | $3.65M |

50 issuers | $3.3M | $1.2B | $60M |

250 issuers | $16.7M | $6.1B | $305M |

1,000 issuers | $66.7M | $24.3B | $1.22B |

These projections assume the beta test average of approximately $67,000 daily volume per issuer. Actual volume varies by issuer market cap, shareholder base, and trading interest. With more than 11,000 OTC companies representing the addressable market, even modest market penetration generates substantial protocol revenue.

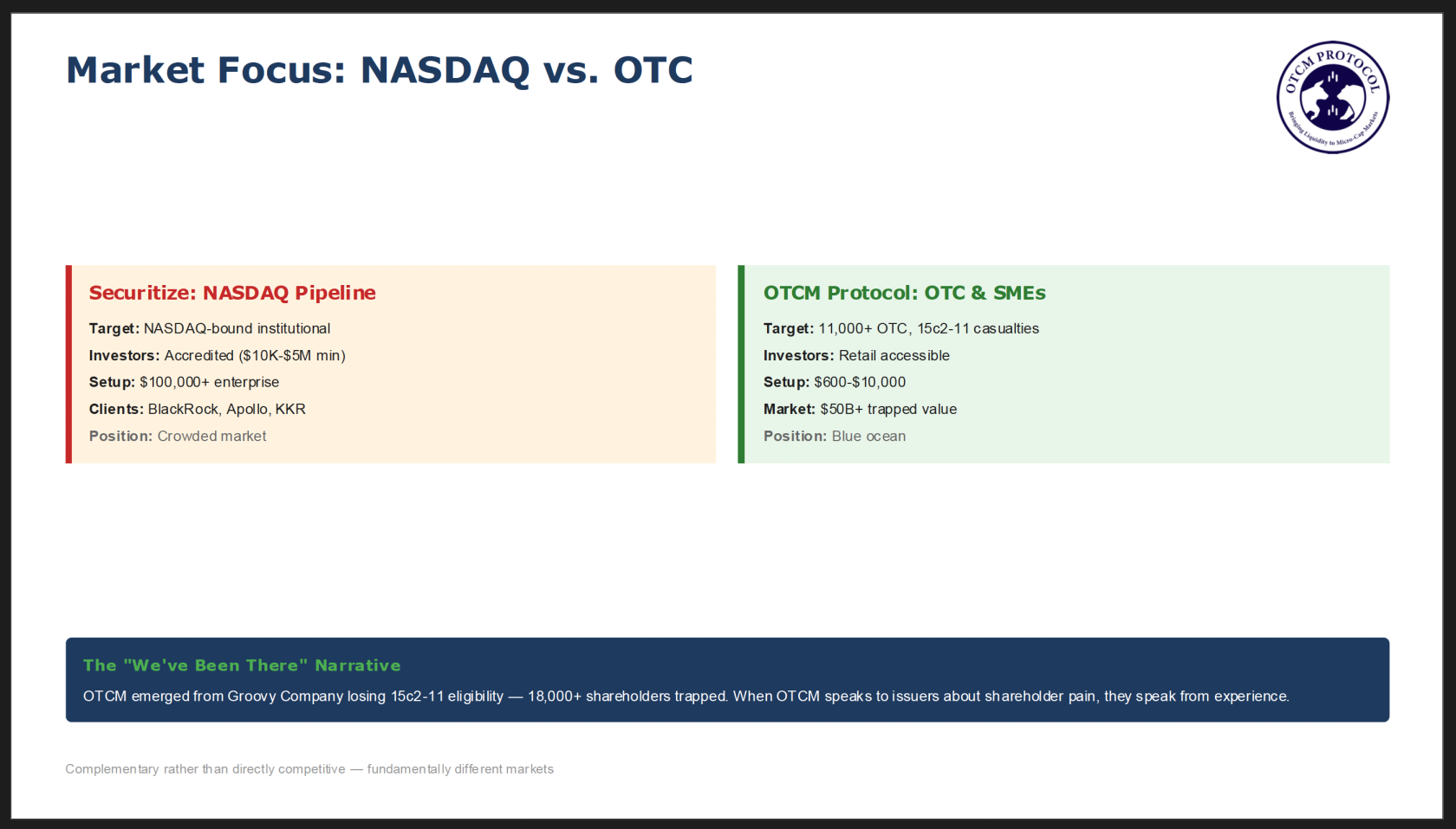

🎯 Market Focus: NASDAQ vs. OTC and Secondary Global Markets

Beyond technology and business model differences, Securitize and OTCM Protocol pursue fundamentally different market strategies. This strategic divergence explains why these platforms are complementary rather than directly competitive, and why OTCM Protocol's addressable market may ultimately prove larger and more aligned with blockchain's democratizing mission.

🔴 Securitize: The NASDAQ Pipeline

Securitize explicitly targets the premium end of the market, focusing on companies with NASDAQ aspirations and institutional investors with significant capital. The client list including BlackRock, Apollo, and KKR, along with product design featuring high minimums and institutional custody, reflects this focus.

- 🎯 Target: Enterprise issuers such as large funds, established companies, and institutional-grade assets

- 👤 Investors: Institutional investors including accredited investors, family offices, and institutional allocators

- 💸 Minimums: Minimum investments of $10,000 to $5,000,000 exclude retail participation

- 💵 Setup: Setup fees exceeding $100,000 create barriers for smaller issuers

- 📍 Focus: Assets positioned for eventual traditional exchange listing

🟢 OTCM Protocol: OTC and Global Secondary Markets

OTCM Protocol targets the vast, underserved market of illiquid securities comprising thousands of companies too small for institutional attention but too valuable to languish in illiquidity.

- 🏢 OTC Companies: The platform serves OTC companies on OTC Markets across Pink, OTCQB, and OTCQX tiers with limited liquidity

- 📉 15c2-11 Casualties: It addresses the needs of companies that lost market maker support and became effectively untradeable

- 🌍 Global SMEs: Global SMEs seeking capital market access

- 👥 Retail Investors: Retail investors trapped in illiquid positions represent additional target segments

- 💸 Setup Costs: $600-$10,000 enable broad market participation

📊 Market Focus Comparison

Dimension | Securitize | OTCM Protocol |

|---|---|---|

🎯 Primary Target | NASDAQ-bound institutional assets | OTC companies, 15c2-11 casualties, global SMEs |

👤 Investor Focus | Accredited/institutional ($10K-$5M min) | All qualified investors (retail accessible) |

💸 Setup Costs | $100,000+ enterprise pricing | $600-$10,000 issuer-friendly |

📊 Market Size | Premium segment (well-served) | $50B+ trapped shareholder value (underserved) |

📍 Competitive Position | Crowded institutional market | Blue ocean opportunity |

💔 The "We've Been There" Narrative

OTCM Protocol's origins in Groovy Company provide authentic credibility that institutional competitors cannot replicate. Groovy Company experienced firsthand the devastating impact of losing 15c2-11 eligibility and watching more than 18,000 shareholders become trapped in illiquid positions. This lived experience, understanding the frustration of holding legitimate equity that cannot be practically traded, informs every aspect of OTCM Protocol's design. When OTCM Protocol speaks to potential issuers about shareholder pain, they speak from experience rather than institutional consulting playbooks.

🌊 Why OTC Markets Represent Blockchain's True Opportunity

The OTC market represents blockchain's greatest opportunity precisely because traditional finance has underserved it. Securitize's institutional clients already have functioning markets, qualified custodians, and regulatory compliance infrastructure. The incremental value of tokenization for BlackRock is efficiency and cost savings.

For OTC companies and their shareholders, tokenization through OTCM Protocol represents transformation from zero liquidity to functioning markets. The value proposition is not incremental improvement but the difference between having a market and having none. OTCM Protocol's $50 billion addressable market consists of trapped shareholder value held by real people who currently cannot sell at any price. This is not a market segment Securitize can economically serve, and it represents the most compelling use case for blockchain-based securities infrastructure.

📊 Part III: Strategic Comparison Matrix

Dimension | Securitize | OTCM Protocol | Advantage |

|---|---|---|---|

⛓️ Token Standard | ERC-3643 on Ethereum | Token-2022 (ST22) on Solana | 🟢 OTCM |

💸 Transaction Cost | $1-40+ gas fees | ~$0.00025 | 🟢 OTCM |

⚡ Transaction Speed | ~15 TPS, 12+ sec | 65,000+ TPS, 400ms | 🟢 OTCM |

👤 Admin Override | Yes (force transfer, freeze) | No (mathematically impossible) | 🟢 OTCM |

🏦 Transfer Agent | Yes (SEC-registered) | Yes (SEC-registered) | ⚖️ Tie |

💧 Secondary Liquidity | ~$600K/day ATS | 24/7 bonding curves + CEDEX | 🟢 OTCM |

🎯 Target Market | NASDAQ/institutional ($100K+ setup) | OTC illiquid securities ($600-$10K) | ⚖️ Different |

📄 Regulatory Licenses | Transfer Agent, Broker-Dealer, ATS, EU | SEC-registered custody, Howey Shield | 🔴 Securitize |

🤝 Institutional Partners | BlackRock, Apollo, KKR | Empire Stock Transfer | 🔴 Securitize |

💰 Valuation | $1.25B | Early stage | 🔴 Securitize |

🌊 Market Opportunity | Premium segment (competitive) | $50B underserved (blue ocean) | 🟢 OTCM |

🏁 Part IV: Conclusion

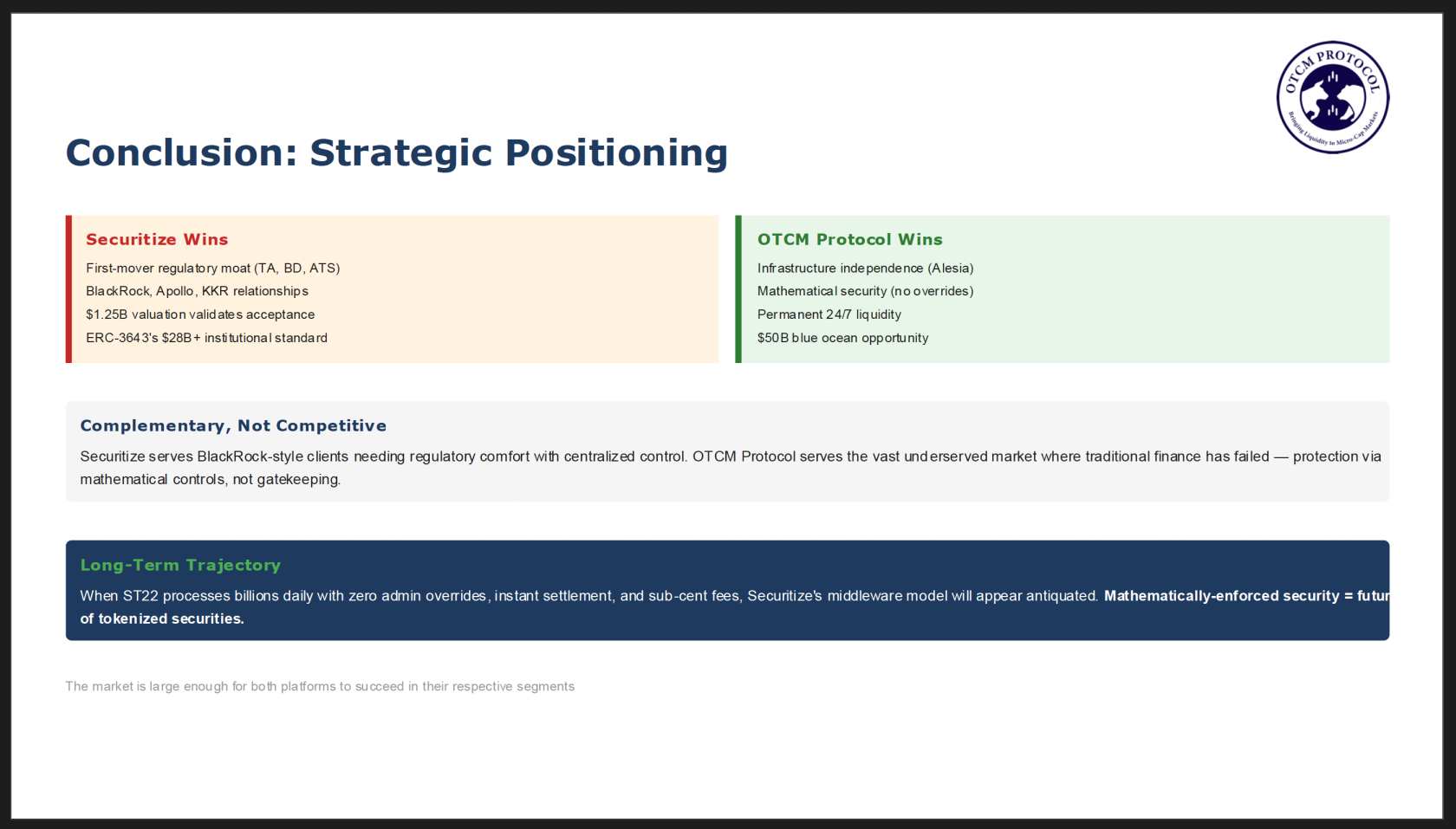

🔴 Where Securitize Wins

Securitize's genuine competitive advantages include:

- ✅ Its first-mover regulatory moat with transfer agent, broker-dealer, and ATS registrations

- ✅ The company benefits from institutional relationships with BlackRock, Apollo, and KKR

- ✅ Its $1.25 billion valuation validates market acceptance of its approach

- ✅ ERC-3643's more than $28 billion in tokenized assets establishes it as the institutional standard

- ✅ Securitize's EU expansion makes it the first firm licensed in both the United States and European Union

🟢 Where OTCM Protocol Wins

OTCM Protocol's structural advantages include:

- ✅ Infrastructure Independence: The Alesia Doctrine eliminates third-party failure vectors

- ✅ Mathematical Security: ST22's mathematically-enforced security cannot be overridden, cannot enable rugpulls, and validates in less than 10 milliseconds

- ✅ Permanent Liquidity: Guarantees 24/7 market access via bonding curves

- ✅ Blue Ocean Opportunity: The $50 billion underserved market opportunity presents a blue ocean with limited competition

- ✅ Issuer-Friendly Economics: Transaction costs 200,000 times lower than Ethereum complete the value proposition

🤝 Strategic Positioning

Securitize and OTCM Protocol serve fundamentally different markets with fundamentally different architectures. Securitize's institutional DNA makes it ideal for BlackRock-style clients who need regulatory comfort and are willing to accept centralized control. OTCM Protocol's infrastructure independence and mathematical security make it ideal for the vast underserved market of illiquid securities where traditional finance has failed.

The competitive threat to Securitize is not OTCM Protocol taking its institutional clients. Rather, it is OTCM Protocol demonstrating that a better model exists. When OTCM Protocol's ST22 architecture processes billions in daily volume with zero admin overrides, instant settlement, and sub-cent fees, Securitize's middleware-on-Ethereum model will appear increasingly antiquated to sophisticated institutional clients.

The market is large enough for both platforms to succeed in their respective segments. However, the long-term trajectory favors OTCM Protocol's approach. Mathematically-enforced security, protocol-level compliance, and infrastructure independence represent the future of tokenized securities, while Securitize's centralized control and external dependencies represent a bridge to that future rather than the destination.

🔒 CONFIDENTIAL — For Internal Strategic Use Only

📄 APPENDIX B: Securitize SEC Letter (October 3, 2025)

78 SW 7th Street, Suite 500 Miami, FL 33130

📅 October 3, 2025

Via Electronic Mail

The Honorable Paul S. Atkins U.S. Securities and Exchange Commission 100 F Street NE Washington, D.C. 20549

Re: Securitize's Compliant, Issuer-Sponsored Security Tokenization Model

Dear Chairman Atkins,

Securitize appreciates the opportunity to provide a high-level overview of the firm's tokenization model as a contrast to some of the alternative offerings that have recently come to market, specifically as it relates to public equities. Securitize provides highly scalable and compliant tokenization solutions via its regulated subsidiaries that cover issuance, distribution and secondary market trading. The firm has pursued an approach that is innovative, leverages frontier-edge technologies of blockchains and smart contracts, all within a highly compliant model, unlike many other current and potential market entrants. We do not need or seek exemptions with respect to existing securities regulations, although some existing rules need to be modernized to accommodate blockchain solutions. It is our view that some of the 'competing' offerings to our approach represent a regulatory arbitrage and create the potential for an uneven playing field for other compliant ecosystem participants.

I. 📋 Tokenization Models

Recent enthusiasm to tokenize public securities has catalyzed a range of offerings that call into question the appropriate form of tokenized assets. Securitize's model is characterized as issuer-sponsored in contrast to some of the other approaches, i.e., we do not believe intermediaries should be tokenizing public equity without the issuer's involvement and assent.

A. ✅ Issuer-sponsored

Securitize Transfer Agent, LLC, a SEC-registered digital transfer agent, works directly with issuers to "natively" (meaning without intermediary layers) issue (or mint) a tokenized public equity.

- The tokenized security is the equivalent of the traditionally issued security.

- The tokenization process involves converting traditional shares held in book entry form at DTCC to a tokenized form that is captured on a blockchain-based master security file of the transfer agent.

- The tokenized security confers the same ownership rights as the traditional security, including voting rights, dividend rights and other corporate actions.

- Investors are always KYC-verified, and their wallets are whitelisted.

- Whitelisting, coupled with rules-based smart contracts, ensures lawful transfers and AML compliance are always enforced throughout the lifecycle of the asset

B. ⚠️ Permissionless "wrapped" tokens

SPVs are created to hold the traditional shares, and a token representing an ownership interest in the SPV is issued (i.e. a wrapped token) to provide exposure to the stock held in the SPV. The wrapped token should be [is] deemed to be a security intrinsically.

- This approach introduces additional counterparty risk to the investor as any potential claims would be against the SPV and not the actual issuer of the stock.

- The wrapped token does not confer any ownership rights equivalent to owning the underlying stock, e.g., voting rights, dividend rights and so forth.

- Lack of KYC: Other than at the point of purchase or redemption, investors who purchase in the secondary market are not subject to any KYC requirements.

- Lack of transfer restrictions: after the initial purchase, the wrapped tokens can be freely transferred from wallet to wallet without verifications or sanctions screening.

C. ⚠️ Derivative securities

Synthetic products that provide exposure to the underlying stock. This is analogous to a total return swap or a security-based swap (SBS) construct and should be deemed to be a security or a security-based swap.

- Exposure is purely economic: The product does not allow redemption for shares or units in the underlying asset and does not offer rights that would attach to a security purchased directly.

- Investors are exposed to counterparty risk of the token issuer and attendant liquidity pool.

- Lack of KYC in cases where the derivative security is permissionless.

- If the security is SBS, the full panoply of SBS rules would have to be addressed, which complicated for US retail investors.

D. 📋 NASDAQ-DTCC Proposal

Without addressing all the specifics of this proposal (NASDAQ proposed rule SR 2025-072), I have a few concerns:

- This proposal contemplates DTCC as the sole tokenization agent for minting and burning security tokens in the National Market System, despite other entities having superior technology and experience in tokenization, including Securitize.

- It does not envision or enable improvements to the proxy distribution process, new types of regulated liquidity pools, or the ability for settlement other than T+1. We believe that blockchain technology and the tokenization of securities should be more aspirational.

We would like to work with NASDAQ and other exchanges and market centers to ensure that any tokenization model that leverages existing (and new) market infrastructure allows for competing tokenization agents, regulated market offerings, and settlement solutions outside of the DTCC complex. Such alternatives could improve the existing proxy distribution process, facilitate near real-time or end-of-day settlement, and enable additional utility, including lending and collateral mobility. At a minimum, as competing models are evaluated, an overarching goal should be to avoid protecting established intermediaries and regulated monopolies where possible.

III. 🔐 Transferability & Token Control: Permissioned vs. Permissionless

Securitize implements smart contracts with rules that govern the transferability of its tokenized securities. Coupled with the KYC verification and whitelisting requirements, this ensures that only eligible and approved investors can engage and transact as smart contracts enforce compliance with suitability, AML and issuer-defined requirements. Moreover, given the smart contract architecture and the existence of an off-chain security master file, any lost, stolen or otherwise impaired tokens can be burned and reissued by the TA (at the direction of the BD or the issuer) such that investors are made whole. These are, therefore, not bearer securities.

In contrast, permissionless, wrapped tokens lack compliance with respect to suitability, AML and the ability to address token impairment; secondary market purchasers are not known to token issuers, and transfers are not governed by smart contract. This result is risky bearer tokens that present regulatory challenges, including money laundering and other illicit uses.

IV. 📊 Secondary Market Trading

Securitize Markets, LLC is a SEC registered and FINRA member broker dealer that operates the Securitize Markets ATS and has bilateral relationships with OTC market makers. The firm's ATS provides several options to compliantly trade tokenized securities, including a standard order book and an RFQ option. The firm plans on offering trading in tokenized NMS stocks and will do so within the existing framework of Reg NMS and related regulations for off chain transactions. We anticipate, initially, offering execution services in partnership with one or more OTC market makers who will fully comply with best execution obligations. Additionally, the firm is approved to conduct dealer activity with respect to tokenized securities, which is also on our roadmap. For on-chain transactions, a de minimis exemption may be required given near real-time settlement and some latency in the block validation process. Nonetheless, at the time of a transaction (match), pricing oracles will be utilized to ensure an execution at or within the prevailing market.

Unlike wrapper or derivative models noted above, natively issued tokens are fungible and are not isolated within the walled gardens of a broker-dealer or other intermediary. Native tokenized securities can be traded in any compliant market center that support digital rails with respect to execution, settlement and custody. Moreover, these tokens support off-chain trading models that subsequently leverage on-chain rails for settlement and custody, such that the requirements of institutional investors can be accommodated.

In contrast, wrapped tokens are generally traded in secondary market venues that are not fungible, not regulated, and do not provide basic investor protections or enforce market integrity. These venues engage in activities that typically define broker-dealer activity (e.g., facilitating transactions in securities, charging commissions and so forth) without adherence to and acknowledgement of well-established securities laws and regulations. The same holds true for tokenized synthetic and derivative products.

In addition to the non-compliant nature of trading, wrapped tokens create practical, market structure inefficiencies given that they are not fungible. Today, there are multiple versions of the same NMS stock trading in siloed pools and characterized by illiquidity due to the constraints of the wrapped model. The net result is additional fragmentation in an already fragmented market, which reduces transparency and market liquidity while increasing counterparty risk and explicit trading costs.

V. 🔗 Composability/De-Fi Integration

Natively tokenized securities can be used to facilitate de-fi use cases, such as on-chain trading, lend/borrow pools and other collateral use-cases within whitelisted ecosystems that embed robust risk management capabilities. The notion that requiring a tokenized security to have a permissionless construct to effectively integrate within de-fi ecosystems is simply a misnomer. In fact, the rate of adoption of tokenized securities by traditional market participants and crypto-forward participants can and will be constrained with non-native models given the limitations previously outlined.

In summary, Securitize has implemented a tokenization model that unlocks utility while avoiding regulatory risk: 1) the model is fully compliant with existing securities regulations and does not require exemptive relief; and 2) the model has been validated in the marketplace, as demonstrated by meaningful AUM outstanding via top-tier issuer partners.

We look forward to further addressing any of the issues raised herein if needed as well as any other questions that may be adjacent to the tokenization of securities in general.

Sincerely,

Carlos Domingo Chief Executive Officer

Cc: Secretary of the Commission The Honorable Mark T. Uyeda, Commissioner, SEC The Honorable Caroline A. Crenshaw, Commissioner, SEC The Honorable Hester M. Peirce, Commissioner, SEC Jamie Selway, Director, Division of Trading and Markets The Crypto Task Force

📄 APPENDIX C: OTCM Protocol Executive Summary

📋 Executive Summary: OTC Meme Protocol (OTCM)

Comprehensive Analysis for the SEC Crypto Task Force

🌟 Overview: Solving America's $50 Billion OTC Market Crisis

The OTC Meme (OTCM) Protocol represents a groundbreaking regulatory-compliant solution to one of American finance's most pressing yet overlooked problems: the systematic abandonment of over 11,000 companies trading on over-the-counter markets, trapping an estimated $50+ billion in shareholder value. Through innovative blockchain technology combined with rigorous SEC compliance, OTCM demonstrates how crypto innovation can revitalize failing traditional financial infrastructure while enhancing rather than circumventing investor protections.

📊 Market Problem Scale:

Metric | Value |

|---|---|

🏢 OTC Companies | 11,000+ with severely impaired liquidity |

💰 Trapped Value | $50+ billion across grey market securities |

👥 Affected Shareholders | 5 million unable to trade existing holdings |

📉 Market Maker Support | 90% of OTC companies lack any |

💸 Annual Compliance Costs | $25,000-$75,000 forcing abandonment |

🔧 Revolutionary Technical Innovation: The Perpetual Preferred Share Model

OTCM introduces an entirely new category of crypto asset that bridges traditional securities infrastructure with blockchain efficiency through a novel "perpetual preferred share" mechanism:

⚙️ Technical Architecture:

- 📜 Preferred Series "M" Creation: Companies create special non-voting, non-dividend preferred, non-144 conversion, non-preemptive strike Preferred shares class specifically and exclusively for tokenization

- 🔒 Permanent Custody: Shares are irrevocably deposited with Empire Stock Transfer, an SEC-registered transfer agent

- ⚖️ 1:1 Token Backing: Each deposited share backs exactly one blockchain token with mathematical precision

- 🤝 Company Commitment: Companies must purchase 40-60% of tokens immediately, demonstrating permanent skin in the game, issuer tokens are locked and have a leak-out mechanism

- 📈 Bonding Curve Trading: Community-driven price discovery through automated market maker mechanics

- 🚀 DEX Graduation: Successful tokens graduate to decentralized exchanges for enhanced liquidity

💡 Key Innovation: Unlike traditional tokenization attempts, OTCM creates permanent, irrevocable separation between tokens and underlying securities, eliminating redemption rights while maintaining asset backing—a structure that satisfies regulatory requirements while providing genuine economic value.

🛡️ Regulatory Compliance Framework: The "Howey Shield"

OTCM operates within existing SEC frameworks through what the project terms the "Howey Shield"—a comprehensive compliance approach that ensures tokens qualify as commodities rather than securities:

⚖️ Howey Test Compliance Analysis:

Element | Present? | Explanation |

|---|---|---|

💵 Investment of Money | ✓ Present | (but insufficient alone) |

🤝 Common Enterprise | ✓ Present | (but insufficient alone) |

📈 Expectation of Profits | ✗ Not Present | Tokens positioned as entertainment/cultural collectibles |

👤 From Efforts of Others | ✗ Not Present | Value derives from community trading activity, not company management |

✅ Result: Tokens qualify as commodities under federal securities law

📋 February 2025 SEC Guidance Compliance:

OTCM fully complies with the Commission's February 2025 guidance on meme tokens by ensuring:

- 🎭 Entertainment/Cultural Purpose: Tokens serve community-building rather than investment functions

- 👥 Community-Driven Value: Price discovery through decentralized market mechanisms

- 🚫 No Profit Promises: Companies make no representations about token performance

- 👁️ Transparent Structure: All operations conducted through registered intermediaries

- 🌐 Decentralized Trading: No central control over secondary market activity

🔐 Enhanced Regulatory Protections:

- 🏦 Professional Custody: Empire Stock Transfer provides SEC-registered custody services

- 🆔 Issuer KYC/AML Compliance: Full identity verification and corporate verification

- 📋 CUSIP Integration: Traditional securities identifiers maintained for regulatory tracking

- ⚠️ Comprehensive Disclosures: Extensive risk warnings exceeding traditional requirements

- 📊 Audit Trails: Complete on-chain transparency combined with traditional recordkeeping

👥 Stakeholder Benefits and Market Impact

👤 For Shareholders (5+ Million Affected Americans):

- 💧 Restored Liquidity: Previously untradeable securities become liquid 24/7

- 📊 Fractional Trading: No minimum investment requirements unlike traditional markets

- 🌍 Global Access: Worldwide trading capability removing geographic barriers

- ⚡ Instant Settlement: Immediate trade finality versus T+2 traditional settlement

- 👁️ Enhanced Transparency: Real-time on-chain visibility of all trading activity

🏢 For Companies (11,000+ OTC Entities):

- 🔒 Permanent Market Support: Eliminates risk of market maker abandonment

- 💰 Reduced Costs: No ongoing market maker fees ($25K-$75K annually saved)

- 🌐 Global Investor Base: Access to international capital previously restricted

- 👥 Community Building: Direct engagement with token holder communities

- ✅ Compliance Simplification: One-time tokenization versus ongoing market support costs

🏛️ For Traditional Financial Institutions:

- 🔐 Safe Crypto Entry: Regulatory-compliant pathway into digital asset markets

- ⏰ 24/7 Operations: Extended trading capabilities beyond traditional market hours

- 💸 Cost Reduction: Elimination of traditional market maker spreads and fees

- 🛡️ Risk Mitigation: Professional custody through familiar SEC-registered entities

- 💧 Enhanced Liquidity: Market-making opportunities in previously illiquid securities

🪙 For Crypto Markets:

- ✅ Legitimate Use Case: Real-world utility beyond pure speculation

- 🔒 Asset Backing: Intrinsic value floor preventing total value destruction

- 📋 Regulatory Clarity: Clear commodity classification enabling institutional participation

- 🌉 Infrastructure Development: Bridge to traditional finance adoption

- 💡 Innovation Catalyst: Template for compliant crypto-traditional finance integration

🛡️ Investor Protection Enhancements

OTCM demonstrates how blockchain technology can enhance rather than diminish investor protections:

🔐 Risk Mitigation Features:

- 🚫 Rug Pull Prevention: Permanent share deposit prevents developer abandonment

- 📊 Asset Backing Floor: Real shares provide intrinsic value floor unlike pure meme tokens

- 🏦 Professional Custody: Institutional-grade security through Empire Stock Transfer

- 👁️ Transparency Maximization: All trading activity visible on immutable blockchain

- ✅ Regulatory Integration: Full compliance with existing investor protection frameworks

⚠️ Comprehensive Risk Disclosure:

- 📈 Extreme Volatility Warnings: Clear communication about community-driven price risks

- 💧 Liquidity Risk Education: Detailed explanation of bonding curve mechanics

- 🔧 Technical Risk Coverage: Smart contract audit requirements and upgrade procedures

- 📋 Regulatory Risk Acknowledgment: Recognition of evolving regulatory landscape

- 🚫 No Investment Promises: Explicit disclaimers about entertainment purpose

📜 Regulatory Policy Implications

OTCM's success demonstrates several critical insights for crypto regulation:

✅ Effective Regulatory Approaches:

- 🎯 Outcome-Based Regulation: Focus on investor protection outcomes rather than technology restrictions

- 🛡️ Safe Harbor Value: Clear guidelines enable compliant innovation versus regulatory avoidance

- 🤝 Traditional Integration: Crypto can enhance existing financial infrastructure rather than replace it

- 🏦 Professional Custody: SEC-registered intermediaries can safely bridge crypto-traditional gaps

- 👁️ Transparency Benefits: Blockchain visibility can exceed traditional market transparency

📈 Framework Scalability:

- 📋 Template Application: OTCM's approach can extend to other illiquid securities markets

- 🌍 International Adoption: Model compatible with international regulatory frameworks

- 🏛️ Institutional Integration: Clear pathway for traditional financial institution participation

- 💡 Innovation Incentives: Demonstrates how compliance can drive rather than hinder innovation

- 📊 Market Efficiency: Shows crypto's potential to solve rather than create market problems

💰 Economic Impact and Market Potential

📊 Immediate Market Opportunity:

Metric | Value |

|---|---|

💰 Value Unlocked | $50+ Billion for trapped shareholders |

💵 Fee Revenue | Sustainable 0.5% trading fee model generates permanent platform revenue |

👥 Employment Creation | New roles in crypto-traditional finance bridge development |

💡 Innovation Catalyst | Template for additional financial infrastructure improvements |

🏛️ Tax Revenue | Enhanced trading activity generates increased capital gains tax revenue |

🚀 Long-Term Systemic Benefits:

- 📈 Market Efficiency: More liquid price discovery for previously abandoned securities

- 💰 Capital Formation: Restored liquidity may encourage new OTC company formations

- 🌍 Financial Inclusion: Global access democratizes previously restricted investment opportunities

- 🔧 Infrastructure Modernization: Demonstrates blockchain's role in financial system upgrades

- 🏆 Regulatory Leadership: Positions US as leader in compliant crypto-finance integration

🏁 Conclusion: A New Paradigm for Compliant Crypto Innovation

The OTCM Protocol represents more than a technical innovation—it demonstrates a fundamentally new approach to crypto regulation that achieves regulatory objectives while enabling genuine innovation. By creating permanent asset-backed tokens that serve entertainment rather than investment purposes, OTCM solves real economic problems while staying clearly within existing regulatory frameworks.

🔑 Key Regulatory Takeaways:

- ✅ Compliance Drives Innovation: Clear regulatory guidance enabled OTCM's development

- 🔒 Asset Backing Enhances Protection: Real backing provides superior investor protection versus pure speculation

- 🏛️ Traditional Integration Works: SEC-registered intermediaries can safely custody crypto assets

- 🎯 Outcome Focus Succeeds: Regulating based on investor protection outcomes rather than technology types proves effective

- 💰 Economic Value Creation: Compliant projects can generate significant economic value for American markets

The Commission's February 2025 guidance on meme tokens has already proven its value by enabling projects like OTCM to proceed with confidence. The success of this framework suggests that continued regulatory clarity will drive further innovation that benefits both crypto adoption and traditional financial market efficiency.

💡 Strategic Recommendation: OTCM's model should be considered as a template for future safe harbor provisions, demonstrating how asset-backed, entertainment-focused tokens can serve legitimate economic functions while maintaining clear separation from securities regulations.

📄 APPENDIX D: OTCM Protocol SEC Letter (January 3, 2026)

📅 January 3, 2026

Via Electronic Mail

The Honorable Paul S. Atkins U.S. Securities and Exchange Commission 100 F Street NE Washington, D.C. 20549

Re: OTCM Protocol - Roadmap for Tokenized Securities on the Solana Ecosystem

Dear Chairman Atkins,

OTCM Protocol ("OTCM") is a financial technology platform focused on tokenizing illiquid over-the-counter securities. We write to endorse the growth of tokenization as an essential innovation for American capital markets, and to respectfully submit our perspective on how the Commission can advance securities tokenization while strengthening investor protection.

OTCM addresses one of American finance's most pressing yet overlooked problems: the systematic abandonment of over 11,000 companies trading on over-the-counter markets, trapping an estimated $50+ billion in shareholder value. Through innovative blockchain technology and the Howey Shield framework—structuring ST22 tokens as community-driven meme tokens consistent with the SEC's February 2025 guidance—OTCM demonstrates how crypto innovation can revitalize failing traditional financial infrastructure while enhancing rather than circumventing investor protections.

The purpose of this submission is to describe the unique market failure OTCM addresses, to explain our regulatory-compliant tokenization model, and to offer our expertise in support of the Commission's efforts to develop clear guidance for tokenized securities. As explained in our attached Roadmap for Tokenized Securities:

📋 Based on our experience operating at the intersection of traditional securities and blockchain technology, OTCM believes SEC tokenization policies should:

- ✅ Support tokenization models that utilize SEC-registered transfer agents as qualified custodians, ensuring institutional-grade custody with regulatory oversight.

- ✅ Recognize the use of public, permissionless blockchains (such as Solana) as consistent with investor protection when paired with appropriate custody arrangements and smart contract security controls.

- ✅ Provide targeted regulatory relief for tokenization models that serve markets abandoned by traditional financial infrastructure.

- ✅ Acknowledge that properly structured tokenized securities can provide superior investor protection through transparent, immutable transaction records and programmable compliance controls, in the meme token environment.

OTCM creates permanent trading markets for securities that traditional finance has abandoned. By combining SEC-registered transfer agent custody with Solana blockchain technology, we replace the opacity of defunct OTC markets with transparent, on-chain trading where every transaction is verifiable. This approach directly serves the SEC's investor protection mission by giving shareholders in abandoned companies something they currently lack: a functioning market and complete visibility into their holdings.

🔑 Key Policy Recommendations:

- 🌐 Permissionless Infrastructure: The SEC should support the use of public, permissionless blockchain systems being incorporated into securities markets as consistent with investors' rights to access liquid markets for securities that traditional infrastructure has abandoned.

- 🏦 Transfer Agent Integration: The SEC should support tokenization models that leverage SEC-registered transfer agents (such as Empire Stock Transfer) as qualified custodians, creating an auditable bridge between traditional securities infrastructure and blockchain technology.

- 👤 Investor Empowerment: The SEC should recognize that blockchain-based securities can provide enhanced investor protection through 24/7 market access, transparent price discovery via bonding curves, and programmable safeguards against market manipulation—protections unavailable in the abandoned OTC markets we serve.

Thank you in advance for considering our perspectives set forth in this letter and in the accompanying Roadmap. We would be happy to answer questions, expand upon our reasoning, and provide more details regarding why we believe Commission action on tokenized securities is warranted. OTCM stands ready to support the Commission's efforts in whatever form may be most useful.

Yours sincerely,

Frank Yglesias Chief Technology Officer OTCM Protocol

Cc: The Crypto Task Force SEC Investor Advisory Committee

📜 APPENDIX E: OTCM Protocol Roadmap for Tokenized Securities

I. 🏢 OTCM Profile

OTCM Protocol's mission is to create permanent market infrastructure for securities that traditional finance has abandoned. Over 11,000 companies trade on OTC markets, yet thousands have become completely untradeable, trapping an estimated $50 billion in shareholder value. Traditional market infrastructure fails these securities through compounding inefficiencies: market makers ignore stocks trading less than $50,000 daily, compliance costs of $15,000-$75,000 annually force companies to abandon market reporting, and once securities fall into the "grey market," traditional finance offers no path to liquidity.

OTCM's approach spans both traditional securities infrastructure through SEC-registered transfer agents and decentralized finance structures through public blockchain deployment. From our perspective, adopting blockchain technology in financial markets isn't about replacing the traditional financial system—it's about creating markets where none exist, serving the millions of shareholders forgotten by traditional finance.

🔧 OTCM's business consists of three main operational areas:

⚙️ Technology Infrastructure

We develop blockchain-based systems that support tokenization of real-world securities assets with regulatory compliance built into the protocol layer.

- 🔗 OTCM Protocol Layer 2: Custom Solana-based infrastructure being developed to enable tokenized securities to operate with institutional-grade security controls, including Transfer Hook extensions for programmable compliance.

- 📈 Bonding Curve AMM: Automated market maker providing algorithmic price discovery and continuous liquidity for tokenized securities without traditional market maker dependency.

- 🏦 CEDEX (Centralized DEX): OTCM's proprietary centralized backend and decentralized frontend exchange built specifically for ST22 Security Tokens. Unlike external DEXs (Raydium, Orca) that cannot invoke Token-2022 Transfer Hooks, CEDEX maintains full Transfer Hook support on every trade, ensuring all 42 security controls remain active throughout the token lifecycle. This solves the critical "graduation problem" where tokens graduating to incompatible exchanges lose their security protections.

- 🛡️ Security Control Framework: SPL Token-2022 Transfer Hook implementation with 42 built-in security controls including circuit breakers, wallet concentration limits, and anti-manipulation mechanisms.

🪙 Creating Tokenized Securities

We support the creation of ST22 Security Tokens on public blockchains, each backed 1:1 by preferred shares held at an SEC-registered transfer agent.

- 📜 ST22 Security Tokens: Tokenized representations of Preferred Series "M" shares created specifically for tokenization—non-voting, non-dividend, permanently held in custody, creating 1:1 backed digital securities.

- 🎫 OTCM Utility Token: Platform governance token providing fee discounts (10-50% based on holdings), DAO voting rights, and staking rewards (8-40% APY through issuer staking nodes).

🏛️ Supporting Markets for Tokenized Securities

We support the trading, settlement, and custody of tokenized securities through compliant infrastructure.

- 🤝 Empire Stock Transfer Partnership: SEC-registered transfer agent serving as qualified custodian for all backing shares, providing institutional-grade security and regulatory compliance.

- 📊 OTCMs Trading Platform: Primary marketplace for ST22 trading with integrated bonding curves and graduation mechanism to decentralized exchanges.

- 🛡️ Howey Shield Framework: As detailed in OTCM's August 2025 submission to the SEC Crypto Task Force, ST22 Security Tokens are structured as meme tokens under the SEC's February 2025 guidance recognizing that tokens serving "entertainment and cultural purposes" with community-driven pricing do not constitute securities. The Howey Shield ensures ST22 tokens fail the Howey test investment contract analysis: no expectation of profits derived from others' efforts, community-driven price discovery through bonding curves, and immediate utility at token distribution.

II. 🌐 General Perspective

We agree with many commentators and financial institutions that global capital markets are entering a new phase enabling mass adoption of tokenization. However, most tokenization efforts to date have focused on assets that already function well in traditional markets—government securities, money market funds, institutional products. OTCM addresses a fundamentally different market segment: securities that traditional infrastructure has actively abandoned.

The crisis we address is substantial: approximately 5 million shareholders hold positions in securities that cannot be traded at any price—not because the underlying companies are worthless, but because no market infrastructure exists to facilitate trades. These shareholders include retired teachers whose mining stocks became untradeable, employees who accepted equity compensation, and families whose generational wealth evaporated when markets abandoned their holdings. Traditional finance offers these investors no hope.

OTCM's products have been developed with a consistent goal: to create permanent market infrastructure through innovative use of preferred shares held in perpetual custody. Unlike temporary market-making arrangements that can be terminated, our model creates infrastructure that cannot be withdrawn, markets that cannot disappear, and value that compounds across generations.

🔑 Key features include:

- 📜 The Preferred Series "M" structure transforms traditional shareholder relationships into permanent tokenization arrangements—companies contribute non-voting, non-dividend preferred shares that OTCM holds in perpetuity, creating continuous market support without ongoing payments.

- 📈 Bonding curve mechanisms effectively provide 24/7 price discovery and instant settlement, replacing unreliable traditional market makers with algorithmic liquidity that cannot be withdrawn.

- 🏦 Empire Stock Transfer's perpetual custody arrangement provides the institutional foundation that makes permanent tokenization credible—once preferred shares are deposited, they are marked with permanent restrictive legends that cannot be removed except through DAO governance approval.

- 🛡️ The "Howey Shield" legal framework structures tokens to emphasize entertainment and community-driven price discovery rather than investment reliance on managerial efforts, while maintaining the 1:1 share backing that provides intrinsic value.

💡 A core thesis of ours is that permanent problems require permanent solutions. Market abandonment is permanent. Shareholder suffering is permanent. Traditional finance's failures are permanent. Our solution must be equally permanent. By building permanent infrastructure through preferred shares held in perpetuity, we create markets that match the permanence of the problems they solve.

III. 🛤️ State of Play: The Three Tokenization Pathways

Even as consensus around the value of tokenization has increased, there continues to be significant lack of consensus on which tokenization models to use. We observe three primary pathways emerging, each of which OTCM's model intersects with in different ways:

A. 📋 Direct Registration

An issuer establishes an on-chain system of records through OTCM Protocol's Issuers Gateway Portal. Security tokens represent a holder's direct legal interest in securities with OTCM Protocol serving as the on-chain system of record. OTCM's Preferred Series "M" shares are custodied with Empire Stock Transfer while the blockchain record is maintained by OTCM Protocol, creating clear legal ownership while enabling tokenization.

B. 👤 Beneficial Ownership

Securities positions are converted to corresponding token positions, tracked and reconciled against control accounts. OTCM's oracle verification system maintains real-time reconciliation between token supply and shares held in custody.

C. 🪙 New Security

A holder of securities issues a new security in tokenized form corresponding to rights in underlying securities. OTCM's ST22 Security Tokens function as new digital native securities backed by the Preferred Series "M" shares—a structure with numerous precedents in equity-linked structured products.

OTCM's architecture combines elements of all three approaches: direct registration through OTCM's Issuers Gateway Portal with custody at Empire Stock Transfer provides legal foundation; beneficial ownership verification through our oracle system ensures 1:1 backing; and the ST22 Security Token represents a new tokenized instrument that can trade on permissionless blockchain infrastructure. OTCM Protocol serves as the authoritative on-chain system of record, maximizing both regulatory clarity and technological capability.

IV. 🔧 OTCM's Unique Technical Innovation

A. 📜 The Perpetual Preferred Share Model

OTCM introduces an entirely new category of tokenized asset that bridges traditional securities infrastructure with blockchain efficiency through a novel "perpetual preferred share" mechanism. The key innovation is permanent separation between tokens and underlying securities, eliminating redemption rights while maintaining asset backing:

- 📜 Preferred Series "M" Creation: Companies create special non-voting, non-dividend, non-redeemable preferred shares specifically designed for tokenization. These shares carry no voting rights (ensuring no governance dilution), no dividend obligations (avoiding ongoing financial burdens), and conditional conversion rights (protecting token holders in default scenarios).

- 🔒 Permanent Custody: Shares are irrevocably deposited with Empire Stock Transfer, an SEC-registered transfer agent, under permanent custody arrangements that cannot be reversed. Restrictive legends cannot be removed except through DAO governance approval with supermajority thresholds.

- ⚖️ 1:1 Token Minting: For each deposited share, exactly one ST22 Security Token is minted with mathematical precision. Oracle verification systems maintain real-time confirmation of backing ratios, with blockchain-anchored cryptographic proofs.

- 🤝 Issuer Commitment: Companies must purchase 40-60% of minted tokens immediately, demonstrating permanent commitment and providing initial liquidity. Issuer tokens are locked with structured vesting (20% at launch, 20% at graduation, 20% every 6 months).

- 📈 Bonding Curve Trading: Community-driven price discovery through automated market maker mechanics replaces unreliable traditional market makers, with DEX graduation upon reaching market capitalization milestones.

💡 Key Innovation: Unlike traditional tokenization attempts that create redemption pathways, OTCM creates permanent, irrevocable separation between tokens and underlying securities. This eliminates redemption risk while maintaining asset backing—a structure that satisfies regulatory requirements while providing genuine economic value to abandoned shareholders.

B. 🔐 The "Mathematically Impossible Rugpull" Architecture

OTCM's technical architecture incorporates 42 comprehensive security controls implemented through SPL Token-2022 Transfer Hook extensions, creating what we describe as "mathematically impossible rugpull" protection:

Control | Function |

|---|---|

🔴 Circuit Breakers | 30% sell threshold triggers automatic trading pause, preventing catastrophic price collapse from coordinated selling |

📊 Wallet Concentration Limits | 4.99% maximum holdings per wallet prevents whale accumulation and reduces manipulation risk |

🔒 Permanent Liquidity Locks | Graduation funds are burned and permanently locked, creating irreversible liquidity commitment |

🤖 Anti-MEV Protection | Jito bundle integration prevents front-running and sandwich attacks |

🔍 Bot Pattern Detection | Multi-layer anti-sniping systems identify and restrict automated manipulation |

These protections are enforced at the protocol level through Transfer Hook extensions—smart contracts that execute automatically on every transaction, providing protection that cannot be circumvented or disabled. This represents a significant advancement over traditional securities markets, where manipulation protections rely on after-the-fact enforcement rather than programmatic prevention.

C. ⚠️ The Meme Token Crisis: A Billion-Dollar Problem

While OTCM addresses the abandoned OTC securities market, our Layer 2 infrastructure also solves the systemic fraud plaguing the broader meme token ecosystem.

The scale of losses is staggering:

Incident | Loss |

|---|---|

💸 Meteora insider trading (Dec 2024 - Feb 2025) | $69M+ |

🚨 Pump.fun scams (99% of tokens) | 18,000 fake tokens by single user |

🤖 Automated manipulation schemes | $3.7M |

These are not isolated incidents—they represent structural failures in how meme tokens are currently created and traded.

🚫 The Core Problems with Traditional Meme Tokens:

💧 Rugpulls and Fake Liquidity:

- No minimum liquidity requirements exist

- Liquidity can be pulled at any time

- No verification process validates liquidity claims

- Wash trading creates fake volume illusions

- On platforms like Pump.fun, 99% of tokens have zero real liquidity

💣 Insider Token Dumps:

- Traditional meme coins allow insiders to dump large token amounts anytime, causing severe crashes

- The $LIBRA token crashed 94% within minutes after a presidential tweet deletion

- ETHEREUMMAX caused 98% value destruction through celebrity-endorsed insider dumps

- No lock-up periods or vesting safeguards exist

🤖 Coordinated Manipulation:

- Platforms like Meteora enabled 150+ wallets to hide ownership while controlling 95% of supply

- Honeypot smart contracts (like SQUID GAME token) trap investors and prevent selling entirely

- Bots create fake volume, lure investors, and coordinate dumps

🚫 Zero Accountability:

- Launching a scam token costs as little as $2-5

- No audit or verification required

- Developers can deploy, dump, and disappear within hours

- No regulatory framework provides investor recourse

D. ✅ How OTCM's Layer 2 Solves These Problems

OTCM's Layer 2 infrastructure, built on Solana's SPL Token-2022 standard with Transfer Hook extensions, provides programmable investor protection that makes the attacks described above mathematically impossible. The Transfer Hook program is invoked on every single token transfer—no exceptions. This is not periodic monitoring or sampling; it is continuous, atomic validation that cannot be bypassed.

🛡️ Layer 2 Protections Against Each Attack Vector:

Attack Vector | OTCM Protection |

|---|---|

🚫 Anti-Rugpull | Minimum $10,000 SOL liquidity locked in smart contracts at launch. Liquidity cannot be withdrawn or manipulated—ever. Graduation funds are burned and permanently locked upon reaching milestones. Transparent on-chain verification of liquidity available to all participants. |

💣 Anti-Dump | 60% of issuer tokens are permanently locked with structured release: 20% at creation, 20% at graduation, then 20% every 6 months. Even project founders cannot dump their allocation regardless of market conditions. Transfer Hook validates vesting compliance on every transfer—violations are atomically rejected. |

📊 Anti-Whale | No single address can hold more than 4.99% of total supply. Prevents the whale accumulation that enables coordinated dumps. The 150-wallet Meteora attack becomes impossible when each wallet is limited to under 5%. |

🔴 Anti-Crash | Automatically halts trading for 24 hours when price drops 30% from reference point. Prevents panic cascades and coordinated dumps. The $LIBRA 94% crash within minutes becomes impossible—circuit breaker triggers at 30%, giving the market time to stabilize. |

⚡ Anti-Flash Loan | Monitors transaction flow and triggers alerts when volume exceeds 100x the rolling 24-hour average. Flash loan attacks concentrate massive borrowed capital into single blocks—our detection freezes the manipulation before it can complete its economic cycle. |

🤖 Anti-Bot | Jito bundle integration prevents front-running and sandwich attacks. Multi-layer anti-sniping systems identify and restrict automated manipulation. Cooldown periods between transactions prevent rapid-fire bot exploitation. |

🎯 Real Attack Scenarios—OTCM's Response:

Scenario | Without OTCM | With OTCM Layer 2 |

|---|---|---|

💣 Insider Dump Attempt | 150 wallets coordinate to dump 95% of supply causing 94% crash | 4.99% max per wallet prevents accumulation; 30% circuit breaker halts trading before cascade; 24-hour cooldown allows market stabilization |

⭐ Celebrity Pump-and-Dump | Celebrity tweets pump price 10x, then dump causes 98% crash | Circuit breakers active on price movement; 60% tokens locked with vesting; gradual cooldowns prevent rapid pump-and-dump cycles |

🚪 Developer Exit Scam | Devs hold 60%, dump at peak, disappear, token worthless | 60% permanently locked via Transfer Hook enforcement; no sell possible regardless of developer intent; exit scam mathematically impossible |

🤖 Wash Trading Manipulation | Bots create fake volume, lure investors, coordinate dumps | 4.99% limit prevents concentration control; volume spike detection identifies artificial activity; on-chain transparency exposes manipulation attempts |

Traditional meme token platforms like Pump.fun charge $2-5 to launch with no audit, no limits, and no accountability. OTCM Protocol requires minimum $10,000 SOL liquidity locked in smart contracts, smart contract audit and verification, liquidity locked on-chain to prevent rugpulls, all 42 security controls activated via Transfer Hook, and clear graduation path to higher liquidity milestones.

💡 This is not incremental improvement—it is a fundamentally different security architecture that makes the billion-dollar fraud ecosystem economically irrational to attack.

V. 📋 Actionable Regulatory Recommendations

A. 🎯 OTCM's Perspective

While others may disagree, OTCM's perspective is that SEC-registered transfer agents can serve as effective bridges between traditional securities infrastructure and blockchain technology without requiring fundamental reform of CSD practices. This perspective has logical implications for recommended Commission action:

- ✅ Transfer agent-based tokenization models should be recognized as providing sufficient custody and investor protection for tokenized securities, particularly when combined with smart contract security controls and real-time verification oracles.

- ✅ Both permissioned and permissionless blockchains can be used safely when linked to securities held in custody with SEC-registered transfer agents. The permissionless nature of public blockchains (like Solana) does not inherently increase investor risk when appropriate custody arrangements exist.